AmeriCorps VISTA

Cost Share Billing & Payment

Sponsor Manual

Updated May 2021

2

Welcome to the definitive resource on cost share billing and payments. Please send

suggestions for improving this document to the AmeriCorps Hotline by calling 800-942-

2677, or visiting https://questions.americorps.gov/.

Table of Contents 2

1. The VISTA Cost Share Model 3

2. The VISTA Cost Share Fund and Invoicing a Cost Share Sponsor for Member Service 3

3. The Cost Share Account Statement 3

Accessing the Account Statement 4

Reading the Account Statement 5

4. The Cost Share Invoice 6

Accessing an Invoice 6

Reading an Invoice 7

5. Using the Cost Share Account Statement & Invoices 8

6. Questions about the Account Statement or a Specific Invoice 8

7. Cost Share Reimbursement Payment Options 9

8. Making Electronic Cost Share Reimbursement Payments 9

Clicking on Pay Now 11

Electronic Payment Maximums and Rules Related to Multiple Payments 18

9. Paying Manually by Paper Check for Approved Sponsors 18

10. Reimbursement Payment Solutions 19

Missing Payments 19

Requests for Duplicate Invoices 19

Pre-Payment Alternative 19

Requesting a Refund for an Overpayment or a Credit Balance 19

Delinquent Balances and Repayment Plans 20

Appendix A: Using the Pay Now Functionality: A One-Page Summary 21

Appendix B: VISTA Cost Share Reimbursement Payments Overview 22

3

1. The VISTA Cost Share Model

AmeriCorps Volunteers in Service to America (VISTA) is an anti-poverty program

that provides full- time volunteers to nonprofit organizations, educational

institutions, and local governmental agencies that serve low-income communities.

The VISTA program is funded each year by an appropriation from the U.S.

Congress that supports the work of VISTA projects across the country.

The VISTA program uses cost sharing as a strategy to expand the number of

VISTA members that can be supported each year. Through cost sharing, a

sponsoring organization pays the living allowance for one or more of its VISTA

members (including members, leaders, and/or summer associates). The VISTA

program provides for other costs for each VISTA member, such as training, a

health benefit, a Segal AmeriCorps Education Award/cash stipend upon

successful completion of service, and travel or relocation costs.

2. The VISTA Cost Share Fund and Invoicing a Cost Share Sponsor

for Member Service

In the standard program model, AmeriCorps pays the living allowance directly

to all VISTA members on a bi-weekly basis, and then invoices the sponsor, also

bi-weekly, for reimbursement of the living allowance that was paid to the cost

share VISTA members.

Living allowances for regular (non-cost share) VISTA members are funded by the

VISTA program’s annual Congressional appropriation, while the living allowances

for cost share VISTA members are paid from a special account called the VISTA

Cost Share Fund (The Fund). The Fund received a one- time cash infusion from

Congress in 2007 for the specific purpose of paying living allowances for cost

share VISTA members and is replenished by the reimbursement payments made

to AmeriCorps by cost share sponsors. Since the value of The Fund is limited to

the amount of the one-time cash infusion from Congress in 2007, submission of

regular and timely reimbursement payments by cost share sponsors is critical to

The Fund’s endurance.

3. The Cost Share Account Statement

An account statement represents a sponsor’s full billing and collections history

as a cost share sponsor. The account statement is also the access point for

invoices. Available in eGrants, the account statement provides a complete

summary of invoice and payment amounts, sorted by agreement number.

Sponsors are responsible for accessing account statements in eGrants.

Since account statements are accessed through eGrants, anyone who wants to

view an account statement must have their own active eGrants account. Every

4

sponsoring organization has identified a staff person to serve as its eGrants

“Grantee Administrator.” Contact your organization’s Grantee Administrator if

you have questions about accessing eGrants.

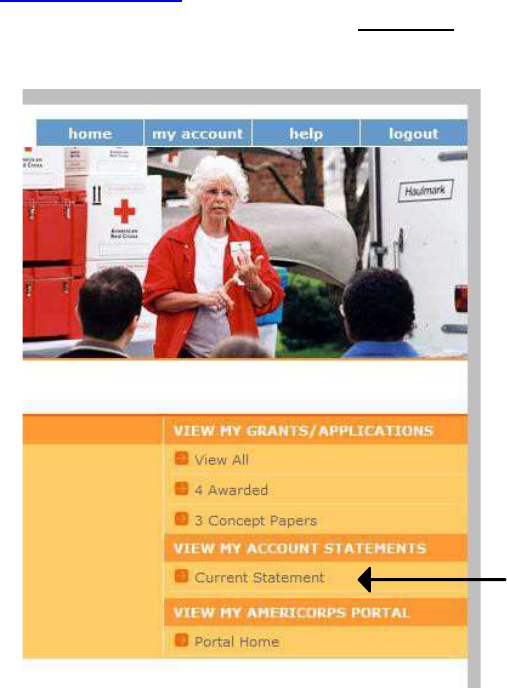

Accessing the Account Statement

Click here to log in to eGrants. Once you are logged in, click on the Current

Statement link on your homepage to access a real time version of the account

statement:

If you log in to eGrants but don’t see a Current Statement link on your

homepage, it means you do not have the necessary roles assigned to your

eGrants account. A sponsor staff person needs the “Grantee Administrator”

role or access to the grant information (i.e., either the “Grantee” or “Grantee

without access to budget” role), in conjunction with the “View Cost Share

Invoices” role.

5

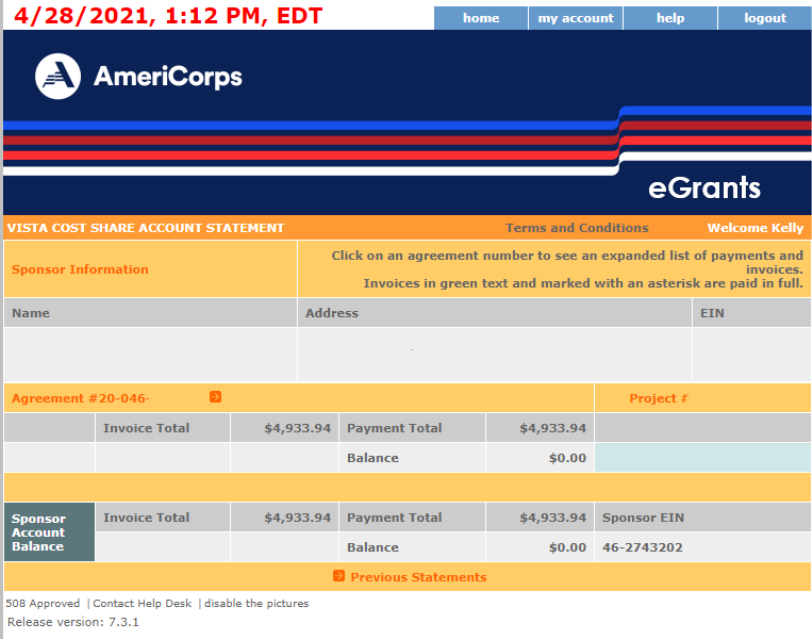

This is what an account statement looks like:

Reading the Account Statement

• There is an invoice total, payment total, and overall balance for each

individual agreement the sponsor has had/has with AmeriCorps.

• The invoice total, payment total, and overall balance at the bottom of the

account statement take into account all of the agreements and provide a

bottom-line balance for the account overall.

• If there is a section on the account statement called “Unapplied Payments &

Refunds,” it will reflect one of two things:

o A payment that was received but has not yet been tied to a specific

invoice, or

o A refund that has been paid by AmeriCorps to the sponsor (usually

done by direct deposit).

• Any number in parenthesis is a credit amount.

If the account statement shows that an organization has a credit under one

agreement and an amount due under another agreement, it is not necessary to

request that the credit be moved in order to apply it to a balance due. A credit

anywhere on an account statement is automatically applied to a sponsor’s

bottom line.

6

4. The Cost Share Invoice

An invoice summarizes the charges to a sponsor for a particular period of time.

Invoices are aligned with the two-week member pay periods. They are available

in eGrants on the first Friday following the end of a member pay period.

Sponsors are responsible for accessing all invoices in eGrants.

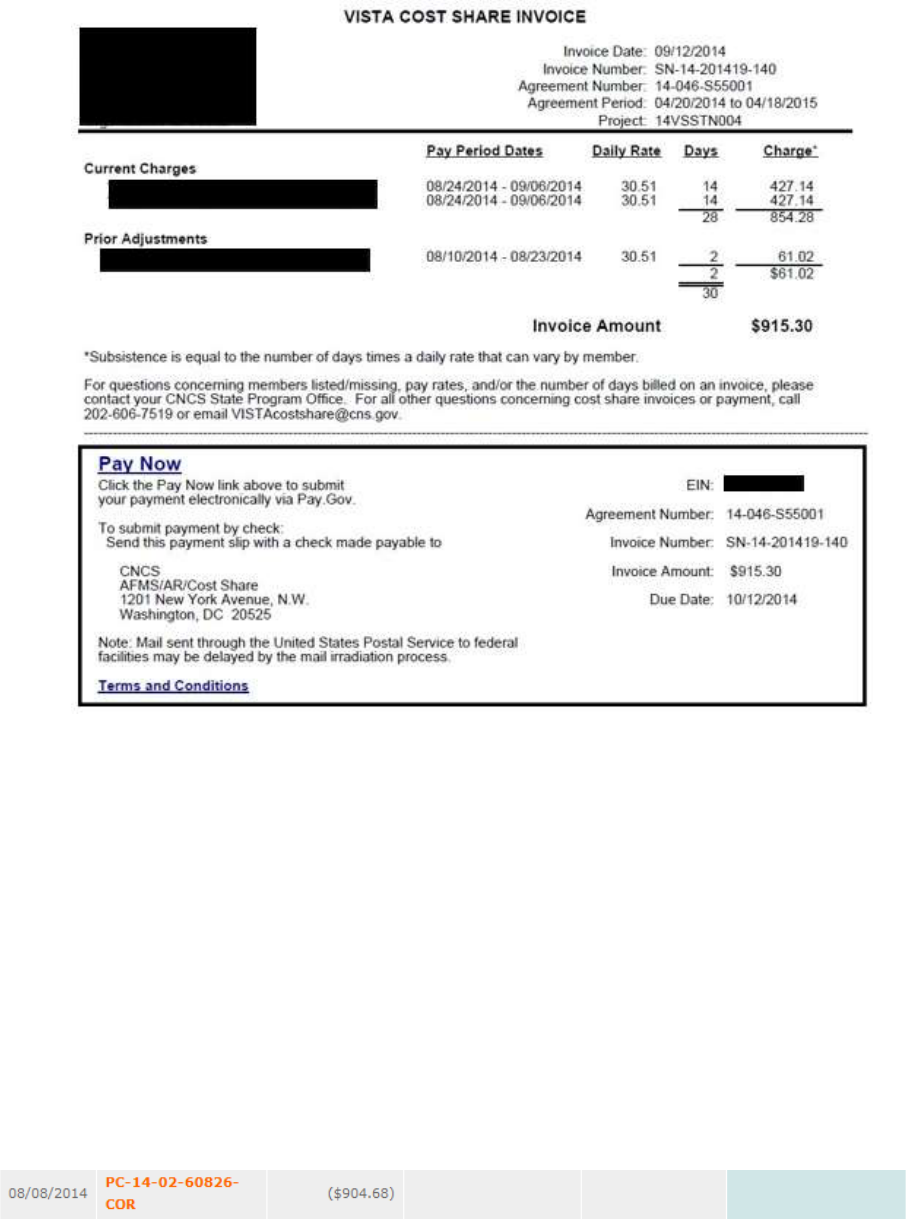

Accessing an Invoice

Invoices are accessed through the account statement. Simply click on an

agreement number to expand the agreement level detail to include all invoice

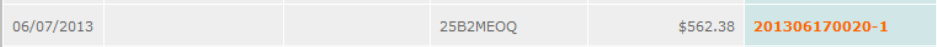

and payment amounts:

Invoices listed in green text and marked with an asterisk have been paid in full.

Invoices listed in orange text have not been paid in full (i.e., they may not have

been paid at all or they may have been paid in part).

7

Click on a specific invoice number to open that invoice as a PDF:

Reading an Invoice

• Under Current Charges, you will find each cost share VISTA member who

served during the previous pay period, along with the date range for the

covered pay period, each member’s daily rate, the number of days the

member served during the covered pay period, and the total charges for

each member.

• The Prior Adjustments section reflects updates to prior invoices that were

processed during the covered pay period. The sum of Current Charges

and Prior Adjustments is reflected under Invoice Amount.

• Credit amounts are shown on an invoice with a negative sign.

• An invoice number that is followed by –COR is the number for an

invoice that has been corrected:

8

5. Using the Cost Share Account Statement & Invoices

The AmeriCorps billing and payment system is a legacy system that has been

used since the 1990s. It has undergone multiple upgrades over the years, each of

which has required migrating data into a new environment. A main purpose of

creating the account statement in 2014 and linking the invoices to it was to

improve data transparency so that sponsors would have more reliable and timely

information against which to reconcile their own records.

• For cost share sponsors with a billing and payment history that predates the

account statement, expand each agreement the first time you review your

account statement, and reconcile the full account statement against your

internal records to ensure the account statement accurately reflects the

totality of all the payments made by your organization over its complete

history as a sponsor. Remember that a credit anywhere on an account

statement is automatically applied to a sponsor’s bottom line, so it is

not necessary to request that a credit be moved in order to apply it to a

balance due.

• Before paying any individual invoice, review it to ensure you agree with the

charges.

6. Questions about the Account Statement or a Specific Invoice

Contact the AmeriCorps Hotline

by calling 800-942-2677, or visiting

https://questions.americorps.gov/

for cost share questions concerning:

Contact your AmeriCorps

Regional Office for cost share

questions concerning:

• Payments made

• Payment methods

• Access to invoices/account statements

in eGrants

• eGrants technical requirements/problems

• Refunds

• Repayment agreements for

delinquent accounts

• Members listed/missing on an

invoice

• Member pay rates

• Number of days billed on an

invoice

• Memorandum of Agreement terms

Whether you are contacting the AmeriCorps Hotline or your AmeriCorps

Regional Office, providing the following information will expedite a response to

your inquiry:

• Sponsor name, exactly as it is stated on the memorandum of agreement

• EIN, Grant #, or Application ID

• Simple statement of the issue/request and the resolution you seek

• Reference data (invoice/agreement number, copy of a pay.gov

confirmation, or copy of both sides of a cashed check)

• Your contact email address and phone number

9

7. Cost Share Reimbursement Payment Options

Pay Now is the special functionality in eGrants that makes it possible for a

sponsor to make a reimbursement payment electronically.

Effective April 30, 2015, AmeriCorps implemented a VISTA Cost Share No Paper

Check Policy and does not accept reimbursement payments from sponsors made

manually with paper checks. See the VISTA Cost Share Reimbursement

Payments Overview, which is found in the appendix of this document, for a

description of current payment options:

• Electronic CREDIT/DEBIT CARD Payment

• Electronic ACH DEBIT Payment

• Electronic PAPER CHECK Payment (under consideration)

• Manual PAPER CHECK Payment

Some sponsors have asked about using Electronic Funds Transfer (EFT) to make

cost share reimbursement payments. EFT requires that the entity to be paid has a

financial institution, account number and bank routing number to provide to the

entity making the payment. Unfortunately, the federal government only has one

overall account (called the Treasury General Fund), so there is no financial

institution/account structure that aligns with our cost share program, or even with

AmeriCorps as an agency, that we can provide to a cost share sponsor who wants

to use EFT.

Please note: AmeriCorps is unable to accept payments by credit card or ACH over

the telephone.

8. Making Electronic Cost Share Reimbursement Payments

The following hardware, software, and settings are recommended in order to

successfully make an electronic cost share payment in eGrants:

• Computer: eGrants is designed to be used with Intel based x86

processors. Any Intel Pentium or newer x86 based PC computer is capable

of successfully running eGrants. Faster Intel x86 processors result in better

performance. Minimum memory requirement is 4GB; more than 4GB will

improve performance.

• Internet Connection: Broadband internet, whether land based or mobile, is

recommended for best performance with eGrants. While Internet service of

T1 (1.5MB/S) or better is recommended, eGrants will function with slower

connection speeds, with a corresponding drop in performance.

• Browser: eGrants is designed and tested to work with Microsoft Internet

10

Explorer. The web browser “popup blocker” MUST be turned off in order

for you to edit or view some eGrants pages. It is not necessary to accept

cookies or to have a Flash viewer loaded to view eGrants.

Sponsors who experience technical difficulties with

making a payment using the Pay Now functionality in

eGrants should contact the AmeriCorps Hotline for

assistance by calling 800-942-2677, or visiting

https://questions.americorps.gov/.

The Pay Now functionality in eGrants is actually a gateway to Pay.gov which is

managed by the U.S. Department of Treasury and the U.S. Federal Reserve Bank

system. Launched in October 2000, Pay.gov is a secure government-wide, web-

based collection portal. Note that the U.S. Department of Treasury’s Pay.gov

system, the host of AmeriCorps’ Pay Now functionality in eGrants, requires that

cookies be turned on/enabled for optimal system performance.

The following information outlines Pay.gov’s security features:

• Pay.gov’s primary, fully redundant and replicated contingency, and test

environments are hosted in the Treasury Web Application Infrastructure

(TWAI), a highly secure environment provided by the Federal Reserve

Information Technology (FRIT) to support several enterprise-wide Treasury

applications. The TWAI is physically located at three Federal Reserve

Banks. The TWAI is built using a zone structure, with firewalls and routers

separating each zone, and complies with the Federal Information

Processing Standard (FIPS) 140-2.

• All communication between Pay.gov and federal agencies (such as

AmeriCorps) is conducted through dedicated lines, virtual private

networks, or 128-bit, hardware-based (on Pay.gov’s side), version 3-only

Secure Sockets Layer (SSL) encryption. The scripts used for invocation of

the collections’ services require encryption, can provide for authentication

of the agency, allow the agency to authenticate Pay.gov, and facilitate the

handling of collection and reporting information. All sensitive data stored

within Pay.gov is encrypted.

• Pay.gov’s security plan meets all FISMA requirements and the business risk

assessment is reviewed annually. The U.S. Treasury conducts full

certification and accreditation of Pay.gov including environmental and

application penetration testing per FISMA requirements.

• For more information on Pay.gov security, contact Pay.gov customer

service, Monday - Friday, 7:00 AM - 7:00 PM Eastern Time (closed U.S.

government holidays) at 800- 624-1373 (select Option #2), or at

11

Clicking on Pay Now

For a one-page summary of how to use the Pay Now functionality in

eGrants, see the appendix of this document.

Sponsors can access the electronic payment functionality in eGrants by

clicking on the blue Pay Now link that can be found on:

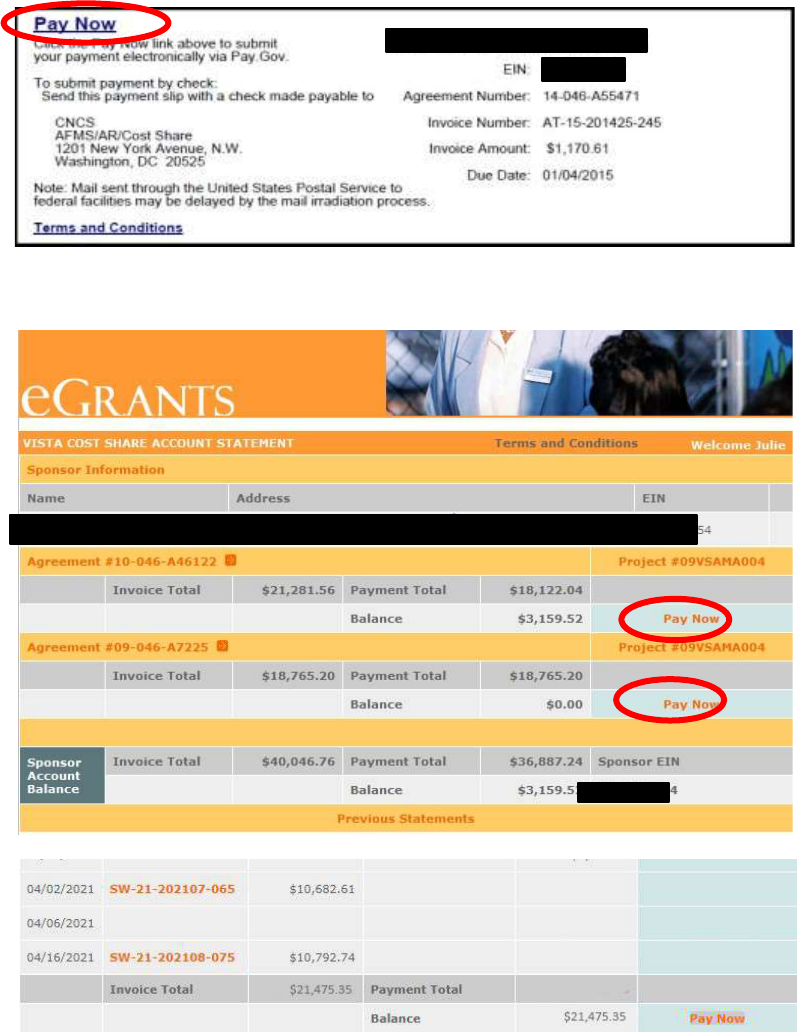

• An individual invoice PDF on the payment slip (recommended):

• The current account statement page:

12

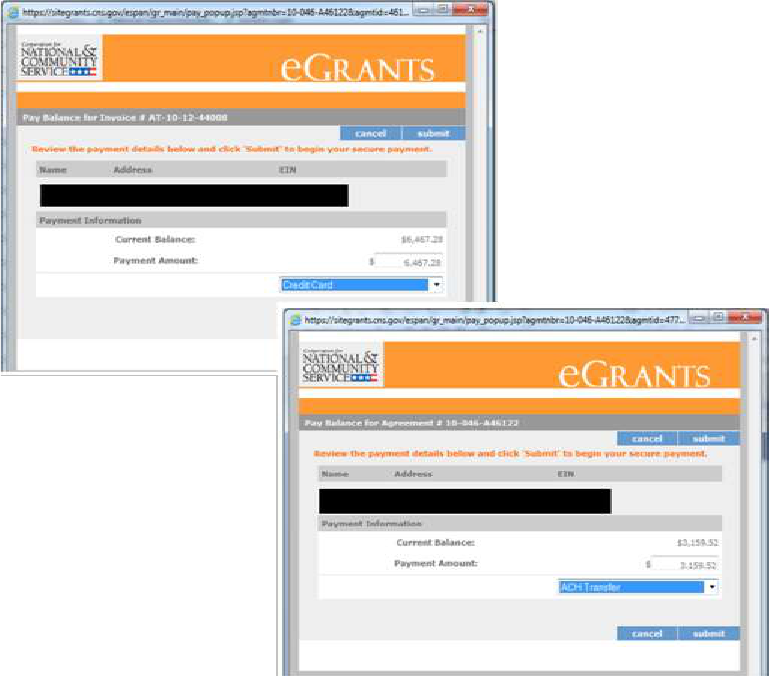

Regardless of which Pay Now link you click on (again, AmeriCorps highly

recommends paying from the invoice PDF to ensure your payment is applied

against the invoice you intend to pay), the following screen will come up, and

you will be asked to choose between making a credit card payment or an ACH

Transfer (making a payment using a checking or savings account):

The Payment Amount will be pre-populated, but you can change it.

13

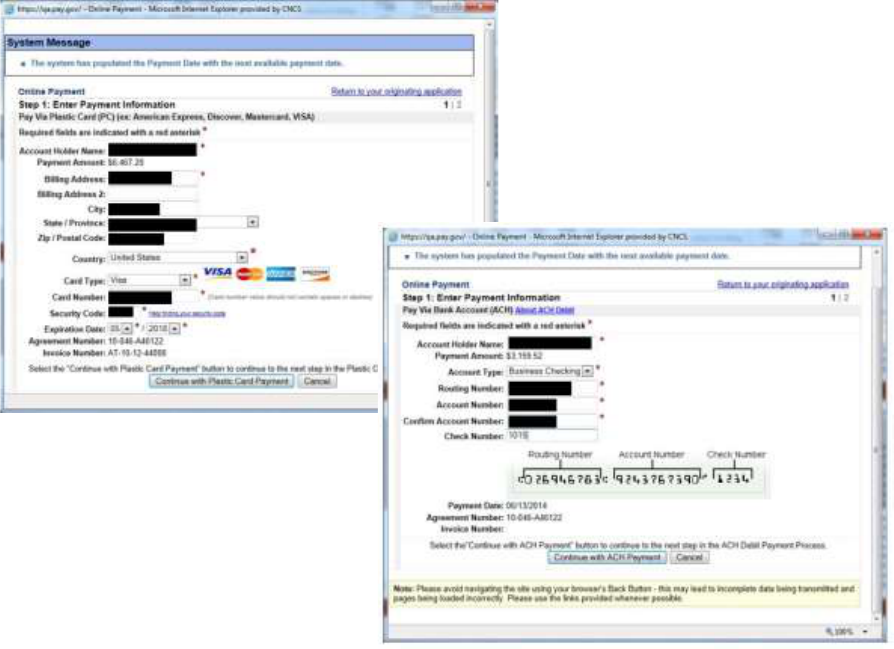

Next, you will enter your payment information:

On the next screen, you will:

• Review a summary of your payment information

• Authorize the payment by clicking the “Submit Payment” button

14

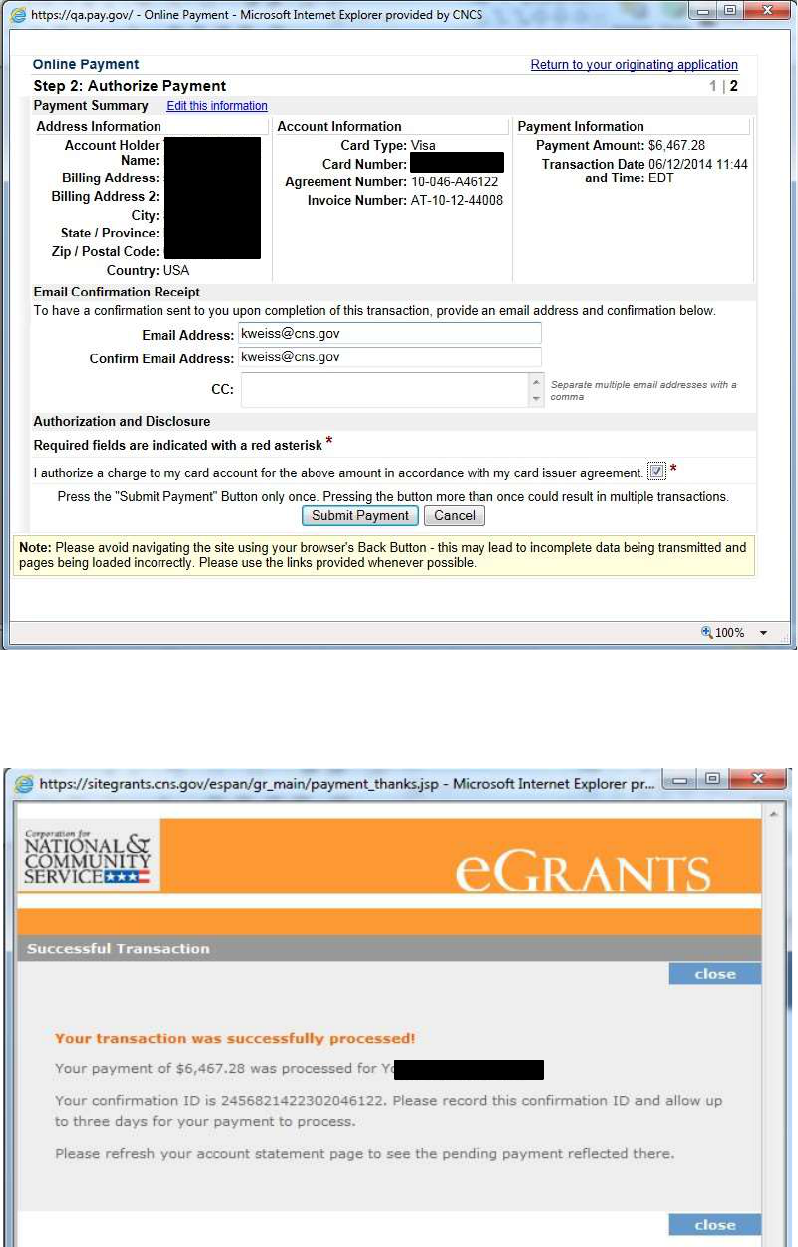

This is what the authorizing screen looks like for a credit card payment (the

authorizing screen for a checking/savings account payment looks similar):

Regardless of which payment method you use, this is what the eGrants

“Successful Transaction” confirmation screen will look like:

15

If you need immediate confirmation of payment, you may wish to take a

screenshot of this message to serve as confirmation of payment as the

system does not send email receipts or confirmations of payment.

Note the last sentence on the message that says, “Please refresh your

account statement page to see the pending payment reflected.” When

you click on the close button on the eGrants “Successful Transaction”

screen, you will be taken back to the current account statement.

A new payment will be illustrated as a “Pending Payment.” “Pending

Payment” amounts are not included in the “Payment Total” for an

agreement or for the bottom-line balance of the account statement.

Sometimes electronic payments are rejected or declined. The most

common reasons include:

• Wrong address information provided for a credit card payment

• Wrong security code provided for a credit card payment

• Insufficient funds

• Wrong account or routing number provided

• ACH Debit Block—Automatic debits to a business account may be

blocked by a bank. This security feature is called an ACH Debit

Block, ACH Positive Pay, or ACH Fraud Prevention Filters. A

sponsor enrolled in such a program provides a list of allowed

company IDs to its bank, and the bank only allows automatic

debits to entities on the list. If the company ID accompanying a

16

request for an automatic debit is not on the allowed list, the

payment is rejected. A sponsor enrolled in an ACH Debit Block

program must contact its bank to have AmeriCorps’ company ID

(9555000105) added to its “allowed” list prior to making any ACH

payments to AmeriCorps.

Payments that are rejected usually appear on the account statement

twice: once as the payment and once as a credit that cancels out the

payment.

On your bank or credit card statement, the payment will usually have the

description "Payment" and text indicating which government agency you

made the payment to, such as “CNCS.” Please note that CNCS represents

the Corporation for National Service, also known as AmeriCorps. If you are

not sure what a particular payment is, contact your bank or credit card

issuer for help in identifying it.

Payments from a bank account (checking or savings) will be charged to the

account the next business day, while payments made with a credit or debit

card will be charged to the account within 24 hours.

Payments are generally settled and received by AmeriCorps on the next

business day after you make your payment, and then it takes a day or

two for the payment to be processed. Weekends and holidays will affect

when you see the payment on your account statement go from

“pending” to complete.

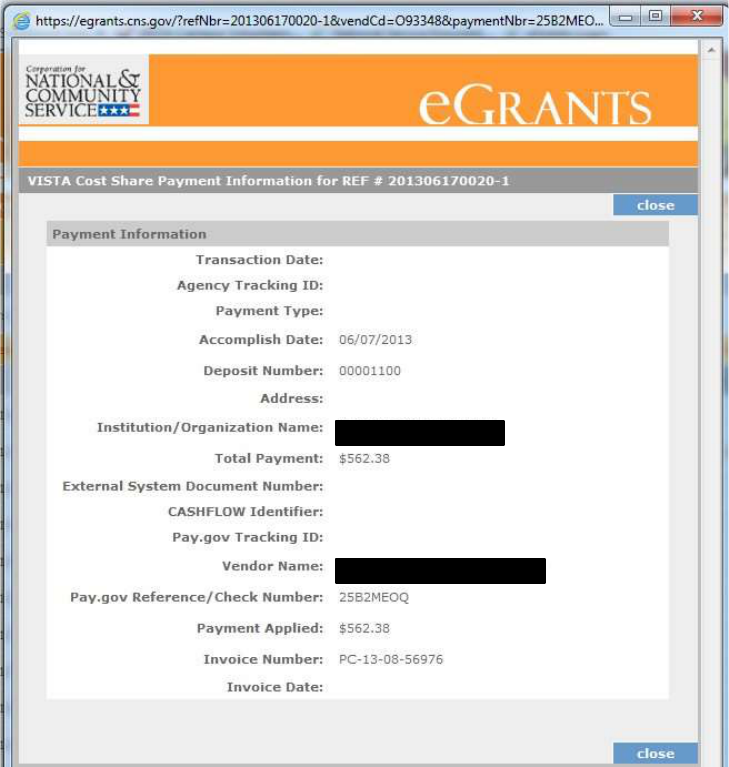

Payments that have completed the posting process are listed on their

own line on the account statement like this:

17

Clicking on the series of orange numbers at the far right of a posted

payment (in the CNCS Reference column) will take you to a Payment

Information popup that will tell you how the payment was applied:

18

Electronic Payment Maximums and Rules Related to Multiple Payments

The U.S. Department of Treasury is in the process of developing a document

with this information. It will be added here as soon as it is available.

9. Paying Manually by Paper Check for Approved Sponsors

As stated above in the section titled “Cost Share Reimbursement Payment

Options,” AmeriCorps does not accept reimbursement payments from

sponsors made manually with paper checks.

Sponsors that can demonstrate that making a payment using the eGrants Pay

Now functionality will be extremely difficult should complete and submit a

Cost Share No Paper Check Policy Exception Request to

The exception form is available on americorps.gov, or you can contact your

Portfolio Manager for it. AmeriCorps will respond to all exception requests in

writing within 10 business days. Exceptions will not be approved based on the

convenience or preference of the sponsor.

Sponsors approved to send paper checks should mail the checks to:

Bureau of the Fiscal Service

200 Third Street, - Avery 3C

P.O. Box 1328

Parkersburg, WV 26106-1328

Description: Agreement #, “VISTA Cost Share,” Project #

If sending a check via overnight delivery, the following address and phone

number should be used. Please inform your sponsor that the phone number is

only for deliveries and will not connect them with the staff at the Treasury.

Bureau of the Fiscal Service

Administrative Resource Center

FAO/FMD/Agency Cash Branch, Avery 3-F

Parkersburg Warehouse & OP/Center Dock 1

275 Bosley Industrial Park Drive

Parkersburg, WV 26101

304-480-8300

Please send a copy of an invoice’s payment slip along with the check to

ensure the payment is posted to the correct invoice. If you are sending one

check to cover multiple invoices, please include multiple payment slips.

19

10. Reimbursement Payment Solutions

Missing Payments

If you make a payment that you do not see reflected on the account statement

after waiting a reasonable amount of time for the payment to process (5

business days for an electronic payment and 20 business days for a paper

check), contact the AmeriCorps Hotline by calling 800-942-2677, or visiting

https://questions.americorps.gov/ and providing the following information to

expedite the research and resolution process:

• If it was an electronic payment, the sponsor should provide a copy

of the payment confirmation page.

• If it was a payment made by check, the sponsor should provide a copy

of the front and back of the cancelled check.

Requests for Duplicate Invoices

Due to limitations of the invoicing system, sponsors may only be invoiced for a

charge one time. Therefore, AmeriCorps cannot re-invoice a sponsor for any

charges (in part or in whole) that are already represented on an existing

invoice. All invoices are accessible to sponsors in eGrants. A sponsor’s Current

Account Statement, reconciled against a sponsor’s internal records, should

serve as the basis for the sponsor making a partial payment against an invoice.

Prepaying for Cost Share Members

Unfortunately, at this time, AmeriCorps does not have the legal authority to

solicit or recommend prepayment, nor can we issue an invoice based on an

estimate. Invoices are always based on living allowance payments that have

actually been made to assigned members.

Requesting a Refund for an Overpayment or a Credit Balance

• If the VISTA project is closed or will no longer be a cost shared project,

AmeriCorps will process a refund requested by the sponsor through the

AmeriCorps Hotline. Contact the AmeriCorps Hotline at 800-942-2677, or

by visiting https://questions.americorps.gov/app/ask.

• All refunds are provided to sponsors through direct deposit.

• If the VISTA project is currently an active project with members serving and

charges continuing to accrue, we cannot refund the credit. However,

please remember that a credit is always automatically applied to a

sponsor’s bottom line. To spend down a bottom-line credit, do not make

any additional payments until the bottom-line credit balance has been

20

exhausted. If a project ends before the sponsor is able to do that fully, we

will be happy to refund any remaining credit.

Delinquent Balances and Repayment Plans

Sponsors are required to pay AmeriCorps the full reimbursement amount set

forth on each invoice, by the date specified on the invoice. Any reimbursement

amount that is unpaid by the date specified on the invoice becomes a

delinquent debt. A sponsor may propose to AmeriCorps that the sponsor be

allowed to repay delinquent debt through a voluntary repayment agreement

in lieu of AmeriCorps taking other collection actions under its debt collection

regulations, including but not limited to denying the continuation of the VISTA

project or suspending/terminating the VISTA project prior to the conclusion of

the last term of service date for all VISTA members assigned to the sponsor.

Please be aware that AmeriCorps does not entertain requests for

waivers or forgiveness of outstanding debt.

Submit initial requests for a repayment agreement to the AmeriCorps Hotline

by calling 800-942-2677, or visiting https://questions.americorps.gov/.

Using the Pay Now Functionality: A One-Page Summary

1. Log in to eGrants: https://egrants.cns.gov/espan/main/login.jsp

You will be taken to your homepage

2. Click on “Current Statement”

The VISTA Cost Share Account Statement will open

3. Click on the most recent Agreement #

A list of all invoices for that particular agreement will open

4. Click on the most recent Invoice #

The invoice itself will open as a PDF

5. Click on the blue “Pay Now” link on the payment slip

The Pay Now functionality will launch

6. Select “Credit Card” or “ACH Transfer,” and click “Submit”

Step 1 of the Online Payment process will open

7. Enter required information, and click on the “Continue” button

Step 2 of the Online Payment process will open

8. Review payment information, enter an email address, click on authorization radio button, and

click “Submit Payment”

Successful Transaction message opens

9. Click on “Close” on the Successful Transaction message

Successful Transaction message closes and you will be taken back to the VISTA Cost

Share Account Statement

10. View the Pending Payment message on the VISTA Cost Share Account Statement

11. Open your email program to view the Payment Confirmation email

Sponsors who experience technical difficulties with making a payment using the Pay Now

functionality in eGrants should contact the AmeriCorps Hotline for assistance by calling

800-942-2677, or visiting https://questions.americorps.gov.

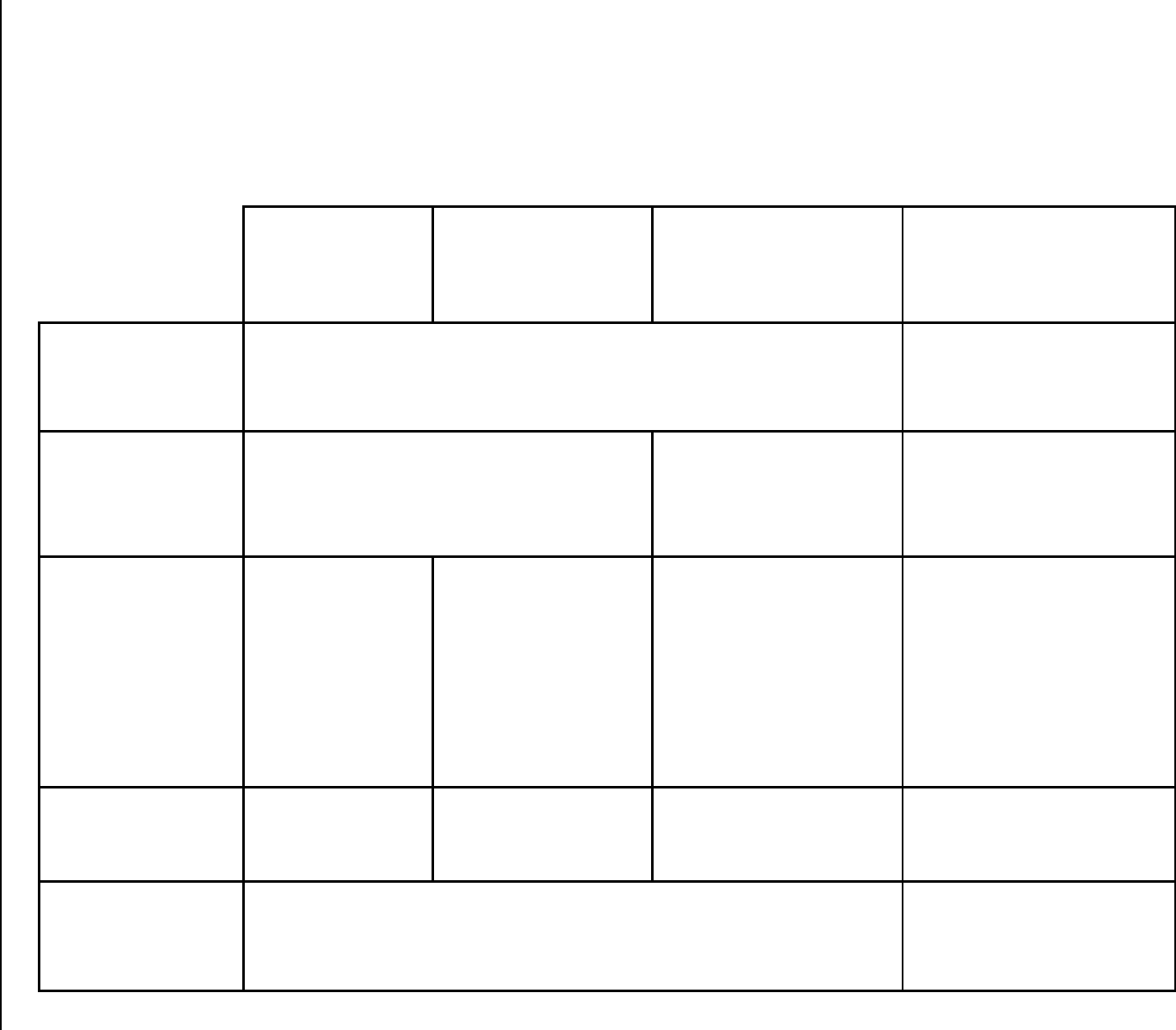

VISTA Cost Share Reimbursement Payments

Overview

Electronic

CREDIT/ DEBIT

CARD

Payment

Electronic

ACH DEBIT

Payment

Under Consideration

Electronic

PAPER

CHECK

Payment

Manual

PAPER CHECK

Payment

Who may use this

payment method?

Any cost share sponsor

Only sponsors with an

approved Exception Form

on file with AmeriCorps may

pay by manual paper check

How does this

payment option

work?

The sponsor enters payment info in eGrants

The sponsor prints the

paper check, enters the

paper check info in

eGrants,

and destroys

the paper

check

The sponsor mails a paper

check to AmeriCorps; check

is processed manually by

AmeriCorps

Cards accepted:

•

Visa credit or

debit

•

MasterCard

credit or debit

•

American

Express credit

•

Discover and

Discover-

branded credit

A sponsor enrolled in

an ACH Debit Block

program must contact

its bank to have

AmeriCorps’ company

ID added to

its

“allowed” list

prior to

making any ACH

payments to

AmeriCorps

A sponsor enrolled in an

ACH Debit Block

program must contact its

bank to have

AmeriCorps’ company ID

added to

its "allowed"

list prior

to making any

electronic paper check

payments

It takes an average of 20

business days for a paper

check to reach AmeriCorps

by mail, be irradiated, and

be posted

Payment will

immediately show as

“

Pending

” on

Account Statement

Yes

Yes

Yes

No

How do I sign up?

It is not necessary to sign up, but it is necessary to have an active

eGrants account with the correct roles

Approved Waiver Required

– contact your AmeriCorps

Regional Office for more

information