10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-1

VOLUME 10, CHAPTER 23: “PURCHASE CARD PAYMENTS”

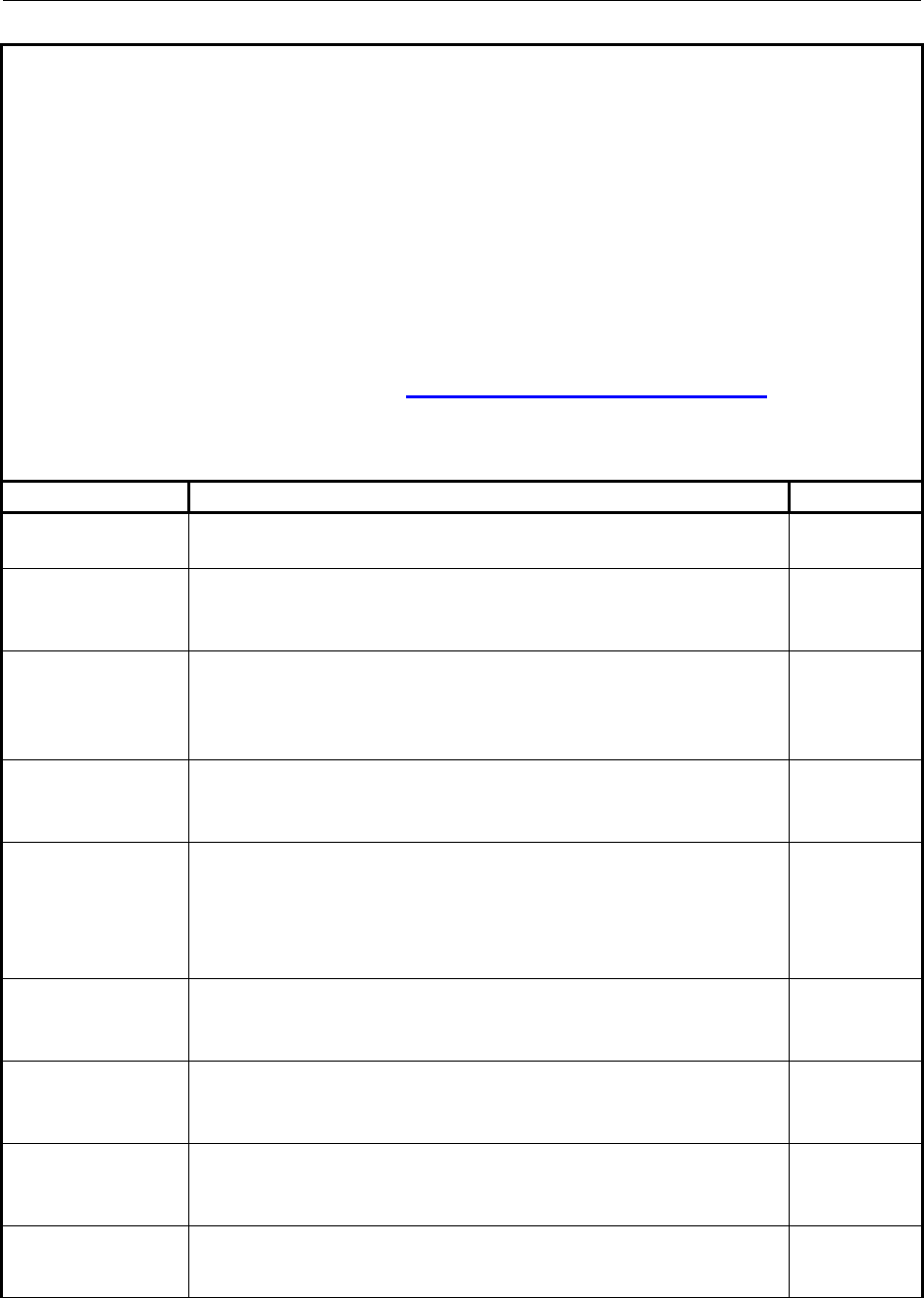

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an asterisk (*) symbol preceding the section,

paragraph, table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated March 2021 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

All

Updated hyperlinks and formatting to comply with current

administrative guidance.

Revision

Throughout

Revised all terminology of “vendor” to “merchant” to more

closely align with Defense Pricing and Contracting (DPC)

policy and guidance.

Revision

Throughout

Revised most references of “DoD Governmentwide

Commercial Purchase Guidebook (the “Guidebook”) to

“DoD GPC Policy” as the DPC website contains more

policies and guidance than just the Guidebook.

Revision

Throughout

Revised terminology of “billing statement” to “Statement of

Account” to more closely align with DPC policy and

guidance.

Revision

2.3

Added a reference and link to the DPC “Final

Governmentwide Commercial Purchase Card Disciplinary

Category Definitions Guidance” for terminology and

definitions of the specific categories of improper purchase

card transactions.

Addition

2.7.2.

Added a reference and link to DPC’s “SP3 Transition

Memorandum #9” to provide policy and clarification

regarding refund review and validation requirements.

Addition

3.7.1.

Clarified purchase log entry and maintenance requirements

in the bank’s Electronic Access System, as prescribed by

DoD Government Purchase Card (GPC) Policy.

Addition

4.3

Added a section to prescribe the role and responsibilities of

the Component Program Manager based on input from the

DPC GPC Program Office.

Addition

5.2.1.

Added clarification of the cardholder’s review process based

on input from the DPC GPC Program Office.

Revision

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-2

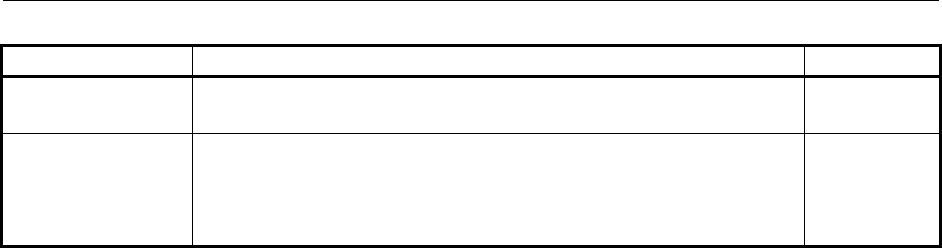

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

5.7

Clarified language concerning the process of disputing

transactions.

Revision

6.6.1.

Revised the review requirements for convenience check

transactions in accordance with the “DoD SmartPay® 3

Government-wide Commercial Purchase Card Policies,

Procedures and Tools – SP3 Transition Memorandum #6.”

Revision

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-3

Table of Contents

VOLUME 10, CHAPTER 23: “PURCHASE CARD PAYMENTS” ........................................... 1

1.0 GENERAL ........................................................................................................................ 5

1.1 Purpose ............................................................................................................... 5

1.2 Authoritative Guidance ........................................................................................ 5

2.0 PURCHASE CARD POLICY ........................................................................................... 5

2.1 Overview .............................................................................................................. 5

2.2 Audits ............................................................................................................... 6

*2.3 Terminology for Unauthorized Purchase Card Transactions ............................... 6

2.4 Purchase Card Accountable Officials .................................................................. 6

2.5 Submission of Billing Statements ........................................................................ 7

2.6 Delegation ............................................................................................................ 7

2.7 Purchase Card Refunds ........................................................................................ 7

2.8 Compromised Account Numbers ......................................................................... 8

3.0 INTERNAL CONTROLS ................................................................................................. 8

3.1 Overview .............................................................................................................. 8

3.2 Monthly Review ................................................................................................... 8

3.3 Separation of Duties ............................................................................................. 8

3.4 Merchant Category Codes .................................................................................... 8

3.5 Data and System Access ...................................................................................... 9

3.6 Penalties for Unauthorized Use of the Purchase Card ......................................... 9

3.7 Documentation ..................................................................................................... 9

4.0 RESPONSIBILITIES ...................................................................................................... 10

4.1 Overview ............................................................................................................ 10

4.2 Head of DoD Component ................................................................................... 10

*4.3 Component Program Manager (CPM) ............................................................... 11

4.4 Agency/Organization Program Coordinator ...................................................... 11

4.5 Commanding Officer or Director ....................................................................... 11

4.6 Payment Review Official ................................................................................... 11

4.7 Purchase Card Certifying Officer ....................................................................... 11

4.8 Approving/Billing Official ................................................................................. 12

4.9 Authorized Cardholder ....................................................................................... 14

4.10 Convenience Check Account Holder ................................................................. 14

4.11 Resource Manager .............................................................................................. 15

4.12 Entitlement Office .............................................................................................. 15

4.13 Disbursing Office ............................................................................................... 16

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-4

Table of Contents (Continued)

5.0 STATEMENT RECONCILIATION AND CERTIFICATION ...................................... 16

5.1 Receipt and Acceptance ..................................................................................... 16

5.2 Cardholder Review ............................................................................................. 17

5.3 Approving/Billing Official Review .................................................................... 18

5.4 Certifying Officer Review .................................................................................. 19

5.5 Payment without Receipt and Acceptance ......................................................... 19

5.6 Payment of the Certified Billing Statement ....................................................... 20

*5.7 Disputed Transactions ........................................................................................ 20

5.8 Summary Accounting ......................................................................................... 20

6.0 CONVENIENCE CHECKS ............................................................................................ 21

6.1 Overview ............................................................................................................ 21

6.2 Printed Convenience Checks and Issuing Bank Requirements .......................... 22

6.3 IRS Form 1099 Requirements for Convenience Check Account Holders ......... 22

6.4 Authorizing and Establishing Convenience Check Accounts ............................ 22

6.5 Conditions for Using Convenience Check Accounts ......................................... 22

6.6 Reconciliation of Convenience Check Accounts ............................................... 23

7.0 CONTINGENCY CONTRACTING EVENTS .............................................................. 24

Figure 23-1. Approving/Billing Official and Certifying Officer Monthly Review Checklist . 25

Figure 23-2. Purchase Card Certification Statements .............................................................. 26

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-5

CHAPTER 23

PURCHASE CARD PAYMENTS

1.0 GENERAL

1.1 Purpose

This chapter provides DoD policy for financial management-related activities within the

purchase card program, including convenience check writing. This chapter supplements general

payment policy described in other chapters, as well as DoD Government-wide Commercial

Purchase Card Program Policy (hereafter referred to as DoD GPC Policy), and Office of

Management and Budget (OMB) Circular A-123, Appendix B. The DoD GPC Policy includes

the DoD Government Charge Card Guidebook (hereafter referred to as the Guidebook) for

Establishing and Managing Purchase, Travel, and Fuel Card Programs. These documents assist

DoD officials in establishing and managing purchase card programs.

1.2 Authoritative Guidance

1.2.1. This chapter establishes policy based on the statutory and regulatory

requirements spelled out in Title 10, United States Code (U.S.C.), section 4754; the Federal

Acquisition Regulation (FAR), Part 13; the Defense Federal Acquisition Regulation

Supplement (DFARS), Part 213; DFARS PGI 213.301; DoD GPC Policy; and the current General

Services Administration (GSA) SmartPay® master contract and applicable task orders.

1.2.2. The Office of the Under Secretary of Defense for Acquisition and Sustainment

(OUSD(A&S)) and the DoD Component Program Managers (CPM) are responsible for oversight

of the purchase card program, to include policy formulation and procedural guidance. The Defense

Contract Management Agency participates in operational oversight of the purchase card program

administered by DoD Components.

2.0 PURCHASE CARD POLICY

2.1 Overview

2.1.1. Through task orders issued on the GSA master contract (SmartPay®3), the DoD uses

third party, card-issuing banks to support the purchase card program. The card-issuing banks

provide a commercial purchase and payment service that replaces the paper-based, time consuming

purchase order process, thereby eliminating procurement lead time, providing transaction cost

savings, and reducing procurement office workload. The use of purchase cards also streamlines

payment processes by consolidating transactions from multiple merchants for payment under a

single invoice. The suite of services offered by the card-issuing banks includes web-based purchase

log entry; electronic invoicing, statement review, approval, certification, and reporting; retention of

transaction supporting data; as well as transaction data mining capabilities. Cardholders use

purchase cards to make and/or pay for authorized government purchases, place and pay for orders

against contracts, make payments against approved Standard Form 182, Authorization, Agreement

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-6

and Certification of Training (as authorized in the DoD Miscellaneous Payment Guidebook), and

pay for intragovernmental transactions. GPC transactions are subject to established limitations on

transaction amount, billing cycle amount, and Merchant Category Codes (MCCs) as described in

DoD GPC Policy.

2.1.2. A purchase card charge authorizes the card-issuing bank to make payment to the

merchant or contractor consistent with the GSA master contract and these regulations. An

authorized purchase is defined as a purchase that satisfies a bona fide need at a fair and reasonable

price that meets all legal and regulatory requirements. Individuals responsible for purchase card

violations (i.e., abuse, delinquency, internal fraud, or misuse) are subject to administrative and

disciplinary actions as described in DoD GPC Policy and Component personnel policies and

procedures.

2.1.3. Purchase card open market transactions are limited to the micro-purchase thresholds

prescribed by FAR 2.101, 10 U.S.C. § 3573, and DFARS PGI 213.201(g) that apply to the

transaction being made. See DoD GPC Policy for specific guidance related to the application of

current DoD micro-purchase thresholds. Any increase to a cardholder’s delegated authority must

be authorized by issuance and acceptance of a new Government Purchase Card Delegation of

Procurement Authority Letter.

2.2 Audits

Pursuant to 10 U.S.C. § 4754(b)(14-15), the purchase card program is subject to periodic

audits by the DoD Inspector General and the Military Services’ audit agencies to determine

whether the program complies with agency policy.

*2.3 Terminology for Unauthorized Purchase Card Transactions

Refer to DoD GPC Policy, OMB Circular A-123, Appendix B, Attachment 6, and DPC’s

“Final Governmentwide Commercial Purchase Card Disciplinary Category Definitions Guidance”

for terminology and definitions of the specific categories of improper purchase card transactions,

including guidance on what is reportable to OMB.

2.4 Purchase Card Accountable Officials

2.4.1. Within DoD, purchase card accountable officials are military members or civilian

employees who are appointed in writing as cardholders, approving/billing officials, and

certifying officers. Such appointments, made in accordance with Volume 5, Chapter 5

(10 U.S.C. § 2773a and 31 U.S.C. § 3528), are necessary to establish pecuniary liability under

the law governing accountable officials, other than those potentially liable under

10 U.S.C. § 4754(c). Accountable officials are responsible for providing information, data, or

services to certifying or disbursing officers in support of the payment process, and are responsible

for attesting to the accuracy of information and data in support of the payment to the card-issuing

bank. In accordance with Defense Pricing and Contracting (DPC) memorandum, “Appointment

of Government wide Commercial Purchase Card Officials –

SmartPay®3 Transition Memorandum #3,” accountable officials within the DoD purchase card

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-7

program must be appointed within the Joint Appointment Module (JAM) of the Procurement

Integrated Enterprise Environment (PIEE).

2.4.2. Foreign national employees cannot serve as purchase card certifying officers or

accountable officials unless they are direct hire employees of the United States Government.

However, prior to making such appointments, commanders must consider the potential

consequences when the Status of Forces Agreements or other treaties do not subject direct hire

local nationals to the same pecuniary liability or disciplinary actions as other DoD employees. If

such appointments are necessary, commanders must consider implementing other management

controls to compensate for the lack of pecuniary liability. Refer to Volume 5, Chapter 1 for policy

regarding accountable officials and foreign national personnel.

2.5 Submission of Billing Statements

Policies, standards, and controls concerning the electronic submission, receipt, and

processing of billing statements and transactions are contained in Chapter 8.

2.6 Delegation

As prescribed by 31 U.S.C. § 3325, the head of an executive agency may delegate the

authority to assign personnel to perform the purchase card invoicing, reviewing, approving, and

certifying responsibilities at the accountable official level. When authority is delegated, DoD

Components will:

2.6.1. Designate each billing office, approving/billing official, and/or certifying officer

within the Component’s activities to receive the official purchase card billing statements; and

2.6.2. Delegate the authority to certify official purchase card billing statements in

accordance with Volume 5, Chapters 1 and 5.

2.7 Purchase Card Refunds

2.7.1. The terms “rebate” and “refund” are used interchangeably throughout the CFR,

OMB guidance, existing legislation, and this chapter. Timely payment of a purchase card billing

statement is a refund computation factor. Purchase card billing statement payments must occur as

soon as administratively possible when the refund offered is greater than the cost of funds as

defined in Title 5, Code of Federal Regulations (CFR), section 1315.8. The DoD will take

advantage of refund offers only when it is economically justified and advantageous to the DoD.

The DoD will follow the guidelines for taking discounts and refunds/rebates found in

5 CFR 1315.8; FAR 32.906(e); and OMB Circular A-123, Appendix B, Chapter 7. Billing

statements will be paid for the amount certified. See Chapter 2 for additional information and

policy concerning refunds/rebates.

* 2.7.2. Refunds attributable to the use of the purchase card may be credited to operation

and maintenance; and research, development, test and evaluation accounts of the DoD which are

current when the refunds are received (see statutory note “Crediting of Refunds” within

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-8

10 U.S.C. § 4754). In accordance with OMB Circular A-123, Appendix B, Chapter 7,

rebates/refunds can be used for any legitimate purchase by the appropriation or account to which

they were returned, or as otherwise authorized by statute. Transaction credits, which are funds

sent back to DoD from the contracted bank resulting from returned items, billing errors,

overpayments, duplicate payments, or erroneous payments, must be credited to the original

appropriation from which they were disbursed. See DPC’s “Refund Validation under

SmartPay®3 - SP3 Transition Memorandum #9” regarding DoD GPC refund validation

requirements.

2.8 Compromised Account Numbers

If an account number is compromised, or if a card has been lost or stolen, the cardholder

must notify the approving/billing official, certifying officer, agency/organization program

coordinator (A/OPC), and the card-issuing bank to close the account immediately.

3.0 INTERNAL CONTROLS

3.1 Overview

All DoD Component purchase card program policies, implementing procedures, and

enterprise risk management programs must ensure the inclusion of internal controls to prevent,

detect, and report improper purchase card transactions. Refer to DoD GPC Policy and OMB

Circular A-123, Appendix B, section 2.4.1 and Attachment 6, for terminology and definitions of

improper or incorrect purchase card transactions.

3.2 Monthly Review

The monthly review checklist (Figure 23-1) is intended as a reference tool for use in

examining the cardholder purchase card statement from the card-issuing bank. Use of the checklist

will assist in delinquency management and avoid account suspensions. Refer to section 5.0 for

cardholder, approving/billing official, and certifying officer responsibilities in the monthly

statement review and reconciliation process.

3.3 Separation of Duties

Managers at all levels will maintain the effective operation of internal controls within the

purchase card program and ensure adequate separation of duties of participants under their control.

The management accountability and internal control requirements prescribed by DoD GPC Policy,

along with those outlined in Chapters 1 and 8, will apply to the operation of a DoD Component

purchase card program.

3.4 Merchant Category Codes

MCCs are used to categorize each merchant according to the type of business in which the

merchant is engaged and the kinds of supplies or services they provide. These codes are used to

limit unauthorized transactions on a card account by blocking purchases from merchants included

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-9

in MCCs identified by OUSD(A&S) as high risk sources for government purchases. DoD policy

concerning MCCs is contained in DoD GPC Policy.

3.5 Data and System Access

Cardholder, approving/billing official, certifying officer, A/OPC, and Resource Manager

(RM) access to government and card-issuing bank’s purchase card data and processing systems

will be limited to that necessary to accomplish required tasks while maintaining proper separation

of duties. Refer to DoD GPC Policy for specific requirements when such personnel transfer to

other duties or depart from the organization.

3.6 Penalties for Unauthorized Use of the Purchase Card

Commanders and supervisors at all levels must ensure compliance with this chapter and

the requirements of DoD GPC Policy. Military and civilian personnel who violate the provisions

of this chapter or DoD GPC Policy, are subject to administrative and disciplinary action. In

instances when an official directs a cardholder to purchase items or services that are subsequently

determined to be violations, the official who directs the purchase may be subject to personal

financial liability and to disciplinary action in accordance with OMB Circular A-123, Appendix B,

Chapter 4, sections 2.5 and 2.10. See DoD GPC Policy for specific policies and requirements

pertaining to disciplinary actions within the Government Charge Card Program.

3.7 Documentation

In accordance with 10 U.S.C. § 4754(b)(7), this Regulation, records management policies,

and DoD GPC Policy, documentation will be maintained at all levels to support the integrity of

the purchase card program and to facilitate the reconciliation and payment of purchase card

transactions. For purposes of disbursing, supporting documentation must include copies of

cardholder billing statements, charge tickets, credit slips and receipts, cardholder purchase log,

invoices, delivery orders, approvals, requisitions, cross references to any related contract or

purchase orders, or telephone and mail order logs.

* 3.7.1. Cardholders will establish clear audit trails for purchase card transactions by

maintaining a purchase log and creating a purchase log entry that includes all fields required in the

DoD GPC Policy for each purchase requirement and maintaining transaction supporting

documentation in the card issuing bank’s Electronic Access System. This ensures cardholder

billing statements, purchase log entries, and supporting documentation are available to the

approving/billing official and certifying officer. This also fulfills electronic GPC disbursing office

record retention requirements and supports auditability.

3.7.2. Volume 1, Chapter 9, Figure 9-1 provides the policy regarding document retention

requirements for financial transaction records related to procuring goods and services, paying bills,

collecting debts, and accounting.

3.7.2.1. On a case-by-case basis, and when determined the records are necessary

to complete reconciliation of payment, collection discrepancies, audit requirements, or for other

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-10

necessary purposes, an extension beyond the record retention period may be warranted. Refer to

44 U.S.C. § 2909 for authorization to retain records for a longer period than specified in disposal

schedules.

3.7.2.2. In the event of account termination for both a cardholder and/or

approving/billing official, management must ensure safeguards are in place to meet retention

requirements.

3.7.3. In accordance with DPC memorandum, “Deployment of Procurement Integrated

Enterprise Joint Appointment Module Government-wide Commercial Purchase Card Cardholder

Appointment Capability – SmartPay®3 Transition Memorandum #10,” the PIEE/JAM is the

mandatory enterprise tool for issuing and retaining GPC program appointments.

4.0 RESPONSIBILITIES

4.1 Overview

The reconciliation and account certification process for Statements of Account received

from the card-issuing bank involves a coordinated responsibility between the cardholder,

approving/billing official, and the certifying officer. Every individual involved in the purchase

card process must report suspected purchase card non-compliances, improper transactions, or

violations through the proper chain of command and in accordance with Component policies (refer

to DoD GPC Policy for definitions of these transactions). They must also complete required initial

and refresher training in accordance with DoD GPC Policy, Component policy, and Volume 5,

Chapter 5 requirements, and comply with the additional responsibilities for contingency operations

and contracting events prescribed in the Guidebook, Appendix B.

4.1.1. Commanders and supervisors at all levels have the authority and the responsibility

to ensure that military and civilian personnel under their supervision use purchase cards only as

authorized. Commanders and supervisors are responsible for addressing purchase card

non-compliances, improper transactions and violations.

4.1.2. Purchase card disbursing and certifying officers are pecuniarily liable for illegal,

improper, or erroneous payments, unless granted relief. Purchase card accountable officials may

also be held pecuniarily liable. Policy concerning liability and relief of liability is available in

Volume 5, Chapter 6.

4.2 Head of DoD Component

The Heads of DoD Components (or their designees) may delegate their authority in writing

for the appointment of cardholders, approving/billing officials, A/OPCs, component program

managers (CPMs), and certifying officers (see Volume 5, Chapter 5 for additional policy

concerning appointments). In addition, Heads of DoD Components are responsible for managing

commanders, directors, or other designated officials and their delegated authority for carrying out

their duties and responsibilities as prescribed in DoD GPC Policy.

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-11

*4.3 Component Program Manager (CPM)

The CPM serves as the Service’s or Agency’s functional representative with the Program

Management Office and is responsible for developing/maintaining hierarchies, ensuring

subordinate CPMs and A/OPCs perform their functions/roles, and interfacing with DoD level

program offices regarding card-issuing bank performance issues in accordance with the DoD GPC

Policy.

4.4 Agency/Organization Program Coordinator

A/OPCs serve as the Agency’s functional representatives and have oversight to manage

and ensure the integrity of the purchase card program. The A/OPC is the individual appointed, as

identified in DoD GPC Policy, with responsibilities associated with the management,

administration, and day-to-day operation of the purchase card program. The A/OPC will jointly

work with the RM in setting and maintaining cardholder spending limits based on estimates of

purchase requirements for the period or a budgetary limit. They may also assist the RM in

providing guidance to the cardholder on any legal or regulatory restrictions on the funds provided.

4.5 Commanding Officer or Director

4.5.1. The military officer in command or the civilian director in charge of an activity has

overall responsibility for implementing the purchase card financial management policies of this

chapter. They have disciplinary authority over cardholders and approving/billing/certifying

officials and must investigate all allegations of purchase card violations. The commanding officer

or director must establish procedures for the activity that will permit rapid investigation and

resolution of purchase card violations. They will convene or order an investigation in accordance

with Volume 5, Chapter 6 and take all appropriate actions resulting from each investigation.

4.5.2. When authority has been delegated by the Head of the DoD Component, the

commanding officer or director will appoint accountable officials in accordance with Volume 5,

Chapter 5.

4.6 Payment Review Official

The review official is an individual that may be appointed by the commanding officer or

director to perform pre- and/or post-payment reviews of payments and perform other duties in

accordance with Volume 5, Chapter 5. The A/OPC may not be appointed as the review official.

4.7 Purchase Card Certifying Officer

The certifying officer is the individual responsible for the accuracy of payments, including

designation of the proper appropriation(s) or other funds, certified to the disbursing office and

disbursing officer. The certifying officer is liable for any illegal, improper, or erroneous payment

processed by the DoD resulting from an inaccurate or misleading certification. The certifying

officer’s appointment must meet minimum qualifications and eligibility requirements as discussed

in Volume 5, Chapter 5. While it is desirable to maintain the greatest separation of duties, it is not

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-12

always practical or possible. The certifying officer and approving/billing official duties may be

performed by the same appointed person as discussed in Volume 5, Chapter 1. See Figures 23-1

and 23-2 for additional information concerning the monthly review checklist and certification

statements. Purchase card certifying officers’ responsibilities, as identified in Volume 5,

Chapter 5, section 3.4 and DoD GPC Policy include, but are not limited to the following:

4.7.1. Ensuring transactions meet the legal requirements for authorized purchase card

purchases;

4.7.2. Ensuring adequate documentation is available for individual transactions and

cardholders have reconciled all transactions with purchase log entries;

4.7.3. Ensuring the facts presented in documents for payment are complete and accurate

to include designation of the proper appropriation(s) or other funds;

4.7.4. Verifying the accuracy of computation of a voucher before certification;

4.7.5. Ensuring internal controls exist to prevent submission of duplicate invoices for the

same transaction;

4.7.6. Ensuring all items and services have been received and procedures are in place to

ensure transactions for items or services not received by the next billing cycle are disputed within

the designated dispute timeline;

4.7.7. Ensuring the cardholder is familiar with the dispute process of the servicing bank

and implementing dispute procedures when warranted. Refer to paragraph 5.7 regarding disputed

transactions;

4.7.8. Reviewing and certifying the Statement of Account and forwarding it to the

designated entitlement and/or disbursing office for payment processing. Figure 23-2 contains the

language for the certifying officer’s certification statement;

4.7.9. Ensuring cardholder billing statement transactions are reallocated to other

accounting classifications, if necessary, prior to the actual certification of the invoice; and

4.7.10. Ensuring the cardholder billing statement and all original supporting

documentation (e.g., receipts, logs, invoices, delivery orders, and approvals) is retained to comply

with the requirements for record retention. This retention must capture and leverage origination

of electronic data contained in automated systems so that it may be shared across the DoD’s various

platforms.

4.8 Approving/Billing Official

The approving/billing official is the individual, appointed by the commanding officer,

director, or designee, with oversight responsibility for a number of cardholders to ensure that all

purchase card transactions are necessary and for official government purposes only.

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-13

4.8.1. Approving/billing officials are responsible for providing information and data to

certifying or disbursing officers in support of the payment process. A purchase card

approving/billing official is responsible for attesting to the accuracy of information and data

provided to a purchase card certifying officer in support of a payment to the card-issuing bank.

Purchase card approving/billing officials are accountable and may be held pecuniarily liable for

any erroneous payments that result from inaccurate information and data, including designation of

the proper appropriation(s) or other funds, provided to a purchase card certifying officer, if the

erroneous payment is the result of negligence relative to the performance of assigned duties.

4.8.2. The approving/billing official will review each cardholder’s billing statement every

month to verify the cardholder was authorized to purchase the items, the government has received

the items, and all accountable property (including pilferable items as defined by the DoD

Component) has been properly recorded on government property accountability records in

accordance with Component procedures. The capitalization threshold and accountability

requirements for property, plant, and equipment purchased are provided in Volume 4,

Chapters 24-28. Each approving/billing official will have a reasonable span of control over

cardholders in accordance with DoD GPC Policy. The approving/billing official’s responsibilities

referenced in DoD GPC Policy include, but are not limited to the following:

4.8.2.1. Coordinating purchase card limits and MCC exclusions with the RM and

A/OPC for cardholders under their purview;

4.8.2.2. Ensuring each cardholder fulfills his or her responsibilities as identified in

DoD GPC Policy;

4.8.2.3. Reviewing/reconciling his or her cardholder’s billing statements and

approving the statement when the cardholder cannot perform this function. A purchase card

checklist, included as Figure 23-1, may be used as a tool by approving/billing officials and

certifying officers to document due diligence in billing statement reviews;

4.8.2.4. Verifying all transactions are legal, proper, and mission essential in

accordance with the FAR, DFARS, and DoD policies and regulations;

4.8.2.5. Ensuring monthly Statement of Account accuracy and forwarding the

monthly Statement of Account and all original supporting documentation (e.g., receipts, logs,

invoices, delivery orders, and approvals) to the certifying officer;

4.8.2.6. Reviewing, approving, and forwarding the monthly Statement of Account

to the certifying officer (if not the same as the approving/billing official). Figure 23-2 contains

the language for the approving/billing official’s certification statement;

4.8.2.7. Resolving any questionable purchases with the cardholder;

4.8.2.8. Notifying the A/OPC of any personnel changes that may require

cardholder or managing account closure;

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-14

4.8.2.9. Notifying the A/OPC and certifying officer (if not the approving/billing

official) of any planned approving/billing official reassignment to other duties or departure from

the installation or activity;

4.8.2.10. Notifying the A/OPC and certifying officer (if not the approving/billing

official) of any lost/stolen cards (in addition to the cardholder notifying the card-issuing bank);

and

4.8.2.11. Completing service and agency-specific training.

4.9 Authorized Cardholder

The cardholder is the individual appointed in accordance with the policies contained in

DoD GPC Policy and Volume 5, Chapter 5. DoD GPC Policy addresses the responsibilities of

cardholders, their required use of a purchase log, and the responsibilities of others charged with

cardholder and cardholder account management, reconciliation, and oversight. From a financial

management perspective:

4.9.1. A cardholder will ensure funds are available prior to making the purchase;

4.9.2. A cardholder will perform a review of the monthly cardholder Statement of Account

as described in paragraph 5.2;

4.9.3. When a cardholder uses the card to make unauthorized transactions, (see paragraph

2.3), the cardholder may be liable for any illegal, improper, or erroneous payment resulting from

those transactions, and be subject to pecuniary liability (including reimbursing the Government

for unauthorized or erroneous purchases through salary offset) or appropriate adverse personnel

actions; and

4.9.4. In cases where an erroneous charge is not disputed timely, the cardholder may also

be held accountable.

4.10 Convenience Check Account Holder

The convenience check account holder is a military member or civilian employee

appointed as prescribed in DoD GPC Policy. In addition to the responsibilities of an authorized

cardholder addressed in paragraph 4.9, the convenience check account holder is also responsible

for ordering, receiving, storing, safeguarding, inventorying, reconciling, and disposing of check

stock. Convenience check account financial management policy is addressed in section 6.0. The

convenience check account holder is responsible for tax reporting for the convenience checks they

issue and for obtaining a signed Internal Revenue Service (IRS) Form W-9, Request for Taxpayer

Identification Number and Certification, so that an IRS Form 1099-MISC can be issued to the

convenience check payee. Reporting requirements are set forth at paragraph 6.3. The convenience

check account holder will not perform the functions of approving/billing officials or certifying

officers on the managing account for which they are a check writer. The commanding officer,

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-15

director, or designee with oversight responsibility will cancel the convenience check privileges of

cardholders who improperly use convenience checks.

4.11 Resource Manager

The RM is the individual designated by an agency to record formal commitments and

obligations into the accounting system. The RM will establish commitments in advance in

amounts no less than the periodic purchase limits authorized for commercial purchase cards or at

the purchase requisition level. Advance reservations of funds are established by the RM (or

equivalent), in conjunction with the assigned A/OPC, and must be considered when setting office,

managing account, and/or cardholder purchase limits. The use of advance reservations of funds

or commitments for purchase requisitions will also ensure positive funds control, precluding

expenditures from exceeding obligations. Policy for recording obligations for the transactions in

this chapter is contained in Volume 3, Chapter 8. The RM responsibilities associated with the

purchase card program, referenced in DoD GPC Policy, include, but are not limited to the

following:

4.11.1. Coordinating funding and spending limits with approving/billing officials and

A/OPCs, to include providing advice on legal or regulatory constraints on the use of funds;

4.11.2. Providing approving/billing officials and cardholders official notification of

funding;

4.11.3. Assigning default and alternate lines of accounting (LOAs), and ensuring they are

entered into the card-issuing bank’s system for electronic invoicing, receipt, and processing;

4.11.4. Providing reallocation authority to cardholders and approving/billing officials,

when necessary. The process of reallocation, which gives the cardholder the capability to select

different LOAs for a transaction rather than the default line, is set up by the cardholder’s supporting

RM;

4.11.5. Receiving and correcting invoice rejects with the certifying officer’s assistance;

4.11.6. Assisting with resolving accounts in a delinquent status and providing payment

information when requested; and

4.11.7. Coordinating with the responsible officials to ensure any unrecorded purchases are

recorded in the period in which they occur and the miscellaneous obligation is reversed timely as

referenced in Volume 3, Chapter 8.

4.12 Entitlement Office

For the purpose of this chapter, the term “entitlement office” is defined as the office that

processes the card-issuing bank’s payment request (i.e., Statement of Account) after certification

by the certifying officer. Responsibilities of the entitlement office include, but are not limited to

the following:

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-16

4.12.1. Verifying the amount certified for payment on the invoice matches the amount

certified per the certified disbursement voucher;

4.12.2. Validating sufficient funds have been obligated in the accounting records;

4.12.3. Notifying the certifying officer and RM within one business day of invoices

rejected, including a detailed reason for the rejection. Upon resubmission of the rejected

transactions, processing will include the Standard Document Number/contract number of the

original transaction; and

4.12.4. Computing late payment interest penalties in accordance with Chapter 7 and

provisions of the card-issuing bank’s contract, if applicable.

4.13 Disbursing Office

The disbursing office verifies that the certifying officer Appointment/Termination Record

(DD Form 577, Appointment/Termination Record – Authorized Signature) has been completed in

the PIEE/JAM and disburses payments to the card-issuing bank. The disbursing office will not

replicate the reconciliation process before making payment on certified purchase card billing

statements. The disbursing office makes an advice of payment available to the bank. See

Volume 5, Chapter 9 for additional disbursing policy.

5.0 STATEMENT RECONCILIATION AND CERTIFICATION

5.1 Receipt and Acceptance

The cardholder will ensure receipt and acceptance and perform proper documentation of

all purchases made. Independent receipt and acceptance by an individual, other than the

cardholder, is required for accountable property purchases and self-generated purchases (i.e.,

purchases lacking a documented requisition/request from someone other than the cardholder).

Accountable property, as identified in DoD GPC Policy, includes sensitive, classified, and

pilferable property type items. Refer to the Guidebook for additional circumstances that may

require independent receipt and acceptance and the use of the Wide Area Workflow module within

the PIEE when the purchase card is used as a method of payment against a contract.

5.1.1. To verify proof of delivery, record the date received, along with the signature (or

electronic alternative when supported by internal controls), printed name, telephone number, and

office designator or address of the receiving official on the sales invoice, itemized packing slip,

bill of lading, or other shipping or receiving document. Record the name of the independent

individual confirming receipt in the cardholder purchase log.

5.1.2. Local procedures may specify additional circumstances (e.g., based on cost)

requiring evidence of receipt by an individual other than the cardholder. The approving/billing

official will verify the existence of receipt and acceptance documentation (e.g., hand receipts for

accountable property). The approving/billing official also may physically verify receipt and

acceptance. Cardholders must timely notify the property accountability official of pilferable,

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-17

sensitive, or high valued property obtained with the purchase card, in accordance with established

property accountability policy.

5.2 Cardholder Review

The cardholder’s Statement of Account from the card-issuing bank details all the

transactions posted against his or her account through the end of the billing cycle.

* 5.2.1. Each cardholder must reconcile his or her Statement of Account, ensure a purchase

log entry has been created for each transaction/purchase, and retain supporting documentation as

specified in DoD GPC Policy to ensure accurate and timely payments. Cardholders will review

their statements to identify any discrepancies and, as appropriate, attempt to resolve the issue(s)

with the merchant or, in accordance with bank procedures, dispute the transaction(s) or report the

external fraud (see paragraph 5.7).

5.2.1.1. Under the billing discrepancy provisions of the GSA master contract, the

cardholder must report cases of fraud to the card-issuing bank, the A/OPC, the commanding officer

or director, and the local procurement fraud investigative authority for investigation and

adjudication. The cardholder must also comply with the bank’s fraud reporting procedures.

5.2.1.2. Known or suspected fraudulent transactions not authorized by the

cardholder must not be approved for payment. If the fraudulent transaction is not removed by the

bank by the end of the billing cycle, the invoice will be manually processed, excluding the amount

of the transaction(s) in question, and then certified for payment. Due to timing issues, if the

transaction in question has already been paid, the bank will issue a transaction credit on the next

billing statement in accordance with the SmartPay contract. Cardholders must identify the reason

the transactions are deemed fraudulent and the date the fraudulent transactions were reported to

the bank in the system. In all instances, the cardholder will attempt to review/reconcile all

transactions during the billing cycle within which they occur so that these fraudulent transactions

are never included in the corresponding cardholder Statement of Account.

5.2.2. If the cardholder cannot resolve the discrepancy by obtaining a credit from the

merchant, then the cardholder will officially dispute the transaction with the card-issuing bank

following the procedures in paragraph 5.7.

5.2.3. The cardholder will sign and date the Statement of Account (preferably

electronically) and forward it, with the necessary supporting documentation, to the

approving/billing official for action. Figure 23-2 contains the language for the cardholder’s

certification statement.

5.2.4. If the cardholder cannot review the Statement of Account upon receipt (e.g., due to

leave or business travel), then he or she will make his or her cardholder Statement of Account and

supporting documentation available to the approving/billing official or certifying officer for timely

review.

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-18

5.3 Approving/Billing Official Review

The approving/billing official must review each transaction made by cardholders under

their managing account to ensure all supporting documentation is available and correct. The

approving/billing official will ensure cardholder reviews have been completed properly; ensure

billing discrepancies have been resolved with the merchant, disputed, or reported as fraud as

necessary; ensure receipt and documentation of all accountable property; verify all transactions

were necessary government purchases; and perform any other functions required by DoD GPC

Policy and other Component policies and procedures.

5.3.1. Under billing discrepancy provisions of the GSA master contract, known or

suspected fraudulent transactions not authorized by the cardholder must not be certified for

payment and must be reported to the card-issuing bank, A/OPC, commanding officer or director,

and the local fraud investigative authority for investigation and adjudication. Refer to

subparagraphs 5.2.1.1 and 5.2.1.2 for additional guidance concerning the review and handling of

fraudulent transactions. If not done so by the cardholder, the approving/billing official should

ensure fraudulent transactions are disputed in accordance with applicable card-issuing bank

procedures, and reported as fraudulent in accordance with the card-issuing bank fraud reporting

procedures, as well as those of the Component.

5.3.2. The government is contractually obligated to pay the card-issuing bank for all

purchase card transactions made by an authorized cardholder other than those successfully

disputed or that result from external fraud. This includes those made by an authorized cardholder

in violation of purchase card policies (e.g., unauthorized or incorrect as defined by OMB Circular

A-123, Appendix B, section 2.4.1). Every purchase made by an authorized cardholder using an

authorized card creates a contractual obligation of the government to pay the card-issuing bank.

Report these purchase card violations to the A/OPC, appropriate authorities, and/or management

officials for investigation and corrective action in accordance with Component policies and

procedures.

5.3.3. For transactions that are determined to be purchase card violations, the

approving/billing official will authorize payment for any items that cannot be returned and pursue

corrective action by reporting the matter to the A/OPC and management officials in accordance

with Component policies and procedures.

5.3.4. For transactions that may be questionable, the approving/billing official will

determine as rapidly as possible whether there is potential fraud or whether the transaction is

otherwise disputable. The mere lack of supporting documentation will not trigger a finding of

fraud or impropriety unless the identity of the item or service, or other facts, would lead a

reasonable person to believe that this was a fraudulent or unauthorized transaction. If the

transaction is determined not to be external fraud, or otherwise disputable, then it must be approved

for payment. The approving/billing official will continue to follow up to obtain sufficient

documentation to support that the transaction is no longer categorized as questionable. The follow-

up work should involve the cardholder, appropriate management, and bank officials as necessary.

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-19

5.3.5. When the approving/billing official is appointed collaterally as the certifying

officer, he or she will also complete the requirements in paragraph 5.4.

5.4 Certifying Officer Review

The certified billing statement is the official invoice for payment purposes.

5.4.1. The certifying officer will review and certify the billing statement (preferably

electronic) and forward it to the designated entitlement and/or disbursing office for timely payment

processing. Figure 23-2 contains the language for the certifying officer’s certification statement.

See Volume 5, Chapter 5 for additional policy concerning certification requirements.

5.4.2. The certifying officer must not certify a known or suspected fraudulent transaction

that was not authorized by the cardholder. The certifier must not certify payments if the card or

the card number applies to transactions generated by an unauthorized user, such as a merchant

entering the wrong card number, or the transaction occurs after reporting the card or card number

lost or stolen. The certifying officer will follow agency procedures for addressing all fraudulent

or abusive transactions, or other instances of purchase card misuse.

5.4.3. Pursuant to 31 U.S.C. § 3528, a certifying officer certifying a voucher (purchase

card billing statement) is responsible for the information, computation, and legality of a proposed

payment under the appropriation or fund. A certifying officer will ensure all transactions are legal,

proper, correct, and satisfy a bona fide need in accordance with government policies, rules, and

regulations. Since payments are to the financial institution, the certifying officer is responsible for

certifying the legality and accuracy of the information pertaining to the amount owed the financial

institution.

5.5 Payment without Receipt and Acceptance

In accordance with DoD GPC Policy, the DoD is authorized to certify invoices for payment

of micro-purchases prior to the verification that all items billed have been received and accepted.

The cardholder, as part of the monthly reconciliation of their Statement of Account, will annotate

instances of non-receipt for recently ordered goods or services on each statement. Each

approving/billing official is required to establish a system and related procedures to flag and track

all transactions certified for payment without verification of receipt and acceptance. These

procedures will ensure that all transactions that have been reconciled and approved for payment

will have their receipt verified no later than 45 days after the invoice date. If there is no

documented evidence verifying receipt and acceptance after the 45-day period, the cardholder must

protect the government’s rights by disputing the transaction. The cardholder is responsible for

notifying the bank of any item in dispute and will have 90 calendar days from the date the

transaction was processed/posted to the account. The cardholder must file a formal dispute in

accordance with paragraph 5.7.

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-20

5.6 Payment of the Certified Billing Statement

The designated entitlement office will pay purchase card invoices (preferably electronic)

upon receipt of the certified billing statement. Attention must be paid to the prompt payment

clock, which starts when the invoice is made available to the DoD on the card-issuing bank’s

website versus when invoices are transmitted to the entitlement office. The entitlement office will

ensure that only the amount certified for payment by the certifying officer is processed for

payment.

*5.7 Disputed Transactions

A transaction dispute may occur in a situation in which the Government questions the

validity of a transaction included on the cardholder Statement of Account. Transactions should be

disputed only after all attempts have been made to resolve the issue directly with the merchant.

Reasons to dispute a transaction include circumstances where the cardholder did not authorize the

transaction, the amount of the transaction is incorrect, the quality or service is unacceptable, the

information on the transaction is erroneous or is a duplicate of an existing transaction, the material

was returned or service was cancelled and a credit was not issued by the merchant within 30 days.

The cardholder must dispute the transaction as soon as possible in accordance with the timetable

and provisions contained in the tailored task orders with the card-issuing bank, the DoD GPC

Policy, and local procedures.

5.7.1. For instances where items appear on the billing statement, but have not been

received, the cardholder will contact the merchant to validate that shipment has been made. For

cases of non-shipment, items will be officially disputed only if the merchant fails to credit the

account in the next billing cycle, or the items are not ultimately received.

5.7.2. Approving/billing officials will monitor cardholder items billed versus receipt

discrepancies to ensure any remaining discrepancies are disputed.

5.7.3. Fraudulent transactions include, but are not limited to, transactions made on lost or

stolen cards, incidences of compromised card numbers, or transactions initiated by unauthorized

third parties. These transactions do not follow the dispute process, but rather must be reported as

fraudulent in accordance with the card-issuing bank fraud reporting procedures, DoD GPC Policy,

and those of the Component.

5.8 Summary Accounting

To reduce transaction processing fees, DoD activities will summarize accounting data,

where systems capabilities are available to preclude any duplication of LOAs, before submitting

certified billing statements and accounting data to the designated entitlement office. Specifically,

DoD activities will “roll up” disbursing data by LOA to eliminate duplicate LOAs on one certified

billing statement.

5.8.1. Approving/billing officials and certifying officers will ensure complete

summarization of billing statements with no duplicate LOAs prior to certification and submission

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-21

of the billing statements for payment. The level of appropriation data summarization will be

consistent with the advance reservation of funds and the data for entry into the accounts payable,

disbursing, and accounting systems in order to maintain positive funds control, match each

planned disbursement with a recorded obligation (as described in Chapter 1 and Volume 3,

Chapter 8), and prevent unmatched disbursements.

5.8.2. The following methods will be used to facilitate summary-level accounting:

5.8.2.1. Use the minimum number of LOAs per purchase card to satisfy mission

requirements;

5.8.2.2. Establish approving/billing official and cardholder relationships, to the

maximum extent possible, which will support summary-level billing statements which are

comprised of multiple purchase cards citing the same LOA; and

5.8.2.3. Use the object class that is most appropriate for the types of transactions

made with the card.

6.0 CONVENIENCE CHECKS

6.1 Overview

Use of convenience checks must be minimized and designated as a purchase instrument of

last resort. They will only be used if the merchant offering the goods or services does not accept

or does not have the ability to process the purchase card, no other merchant can reasonably be

located, and it is not practical to pay for the items using the traditional procurement method.

6.1.1. A discrete account must be set up in order to issue convenience checks.

Convenience check and normal purchase card accounts may be issued under a single managing

account, but they must not be commingled. The transactions reported during the billing cycle for

the convenience check and purchase card accounts will appear on the cardholder’s Statement of

Account.

6.1.2. Convenience check accounts are provided by the card-issuing bank in accordance

with the terms of the tailored task orders with the bank. The card-issuing banks operate a

convenience check writing system that allows DoD activities, including overseas locations, to

make selected purchases and payments using checks to replace cash for official expenses, when

card products and other alternatives have been determined unusable. The card-issuing banks offer

“help desk” assistance and reporting capabilities with a variety of reporting media and frequencies

to assist with performing oversight activities.

6.1.3. Each Component will issue instructions concerning the use of convenience checks.

Individuals delegated as convenience check account holders will be appointed in writing. At a

minimum, the appointment letter will state the specific duties of the check writer, any limitations

on the scope of authority (including dollar limitations), and an acknowledgement of the check

writer’s duties and responsibilities. Convenience checks will not be used for employee

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-22

reimbursements, cash advances, cash awards, travel-related transportation payments, meals, or

payroll/salary payments. For additional information concerning convenience check requirements

and restrictions on their use, refer to DoD GPC Policy.

6.2 Printed Convenience Checks and Issuing Bank Requirements

The GSA contract provides responsibilities of the card-issuing bank for convenience check

accounts. The card-issuing bank will ensure convenience checks are sequentially pre-numbered

duplex documents (one copy for the cardholder’s records and the original for the merchant).

6.3 IRS Form 1099 Requirements for Convenience Check Account Holders

6.3.1. The Defense Finance and Accounting Service (DFAS) has tax form issuance and

IRS reporting responsibilities for the DoD convenience check program.

6.3.2. DFAS obtains the universe of DoD convenience check payment data from the GSA

contracted bank that is responsible for convenience check accounts. DFAS provides the

convenience check payment data to the applicable A/OPC, Account Manager, and Convenience

Check Account Holder for determining the tax reporting requirements and completion of

specifically identified data not available to, or captured by, the contracted bank. The Convenience

Check Account Holder is responsible for ensuring the completion and return of the data to DFAS.

6.3.3. Using the information provided by the Convenience Check Account Holder, DFAS

issues the tax forms to the convenience check payees and electronically reports the data to the IRS.

6.3.4. A/OPCs, Account Managers, and Convenience Check Account Holders that do not

return the requested information to DFAS are responsible for their own tax form issuance and IRS

tax reporting.

6.3.5. Additional tax reporting guidance for convenience check payments is

located at https://www.dfas.mil/contractorsvendors/taxinfo/Convenience-Check-1099PRO/.

6.4 Authorizing and Establishing Convenience Check Accounts

Requests to establish an account for convenience checks must be justified in writing and

in accordance with the provisions established in DoD GPC Policy. A specific individual must be

designated as the account holder responsible for that account via the proper application forms and

delegation of authority letters. Those forms will be submitted through the DoD activity’s existing

purchase card hierarchical structure.

6.5 Conditions for Using Convenience Check Accounts

The authorized threshold for convenience checks is one half of the applicable micro-

purchase threshold (41 U.S.C. § 1902, statutory notes). See DoD GPC Policy and FAR 2.101 for

alternative thresholds pertaining to situations involving declared contingencies or emergency-type

operations either within the United States or outside the United States. In order to maintain

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-23

effective internal controls, approving/billing officials, payment review officials, and certifying

officers will not perform the functions of convenience check custodian or cashier. Additional

conditions on the use of convenience checks are as follows:

6.5.1. Convenience checks will be issued for the exact payment amount, with a prohibition

on splitting purchases, payments, or other amounts among more than one check in order to keep

amounts below the applicable micro-purchase threshold or other assigned limits;

6.5.2. Convenience checks will be used for official government purposes only;

6.5.3. Convenience checks will not be issued as an “exchange-for-cash” vehicle to

establish cash funds;

6.5.4. If convenience checks are mailed to payees, then local internal controls must be in

place to avoid duplicate payments being made to them;

6.5.5. The issuing activity is responsible for all administrative costs associated with the

use of convenience checks. Fees associated with the use of convenience checks are specified in

the GSA contract. At DoD Component election, the costs associated with the purchase of

convenience checks may be expressed as a: (a) percentage; (b) number of basis points; or (c) fixed

fee; and

6.5.6. Convenience checks are negotiable instruments and will be stored in a locked

container, such as a safe, where only the account holder has access. Checks will be accounted for

by recording transactions as they occur in the check register and/or purchase log to maintain

control of number sequence. Local policies and procedures must be implemented to provide

safeguards to prevent physical loss, theft, or potential forgery.

6.6 Reconciliation of Convenience Check Accounts

The convenience check account holder will reconcile the Statement of Account as part of

the monthly billing cycle against his or her supporting documentation in accordance with the

standard payment practices established for the purchase card in section 5.0.

* 6.6.1. Convenience check accounts and transactions must be reviewed in accordance with

the “DoD SmartPay®3 Government-wide Commercial Purchase Card Policies, Procedures and

Tools – SP3 Transition Memorandum #6.” The SP3 Transition Memorandum #6, which phased

out the requirement to perform Annual Managing Account Reviews, requires the review and

approval of each convenience check case (transaction) generated by the bank’s data mining review

tool. Convenience check transaction reviews will ensure each convenience check transaction was

authorized, properly funded and approved, appropriate for Government use, does not exceed

allowable limits, includes supporting documentation, and any other requirement of Component

policies. Any suspected violations will be reported to the appropriate management and

investigative authorities in accordance with established policies (see DoD GPC Policy for

terminology and definitions of the specific categories of unauthorized or inappropriate

transactions).

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-24

6.6.2. The dispute process is not available for convenience checks. Any concerns over a

purchase made with a check will be resolved directly with the merchant. The account holder is

solely responsible for securing restitution and/or credit on disputed purchases.

6.6.3. Stop payments may have an effect on convenience checks, provided the

convenience checks have not been posted to the account. The card-issuing bank will provide the

ability to stop payment on a convenience check within 24 hours. The stop payment fee will be

charged directly to the account.

7.0 CONTINGENCY CONTRACTING EVENTS

The Guidebook, Appendix B, provides the relevant regulatory and related Departmental

policies regarding the use of purchase cards in support of emergency-type operations (e.g.,

contingency contracting events.) The financial management policies related to purchase cards, as

previously identified in this chapter, remain in place for contingency operations and contracting

events unless otherwise noted.

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-25

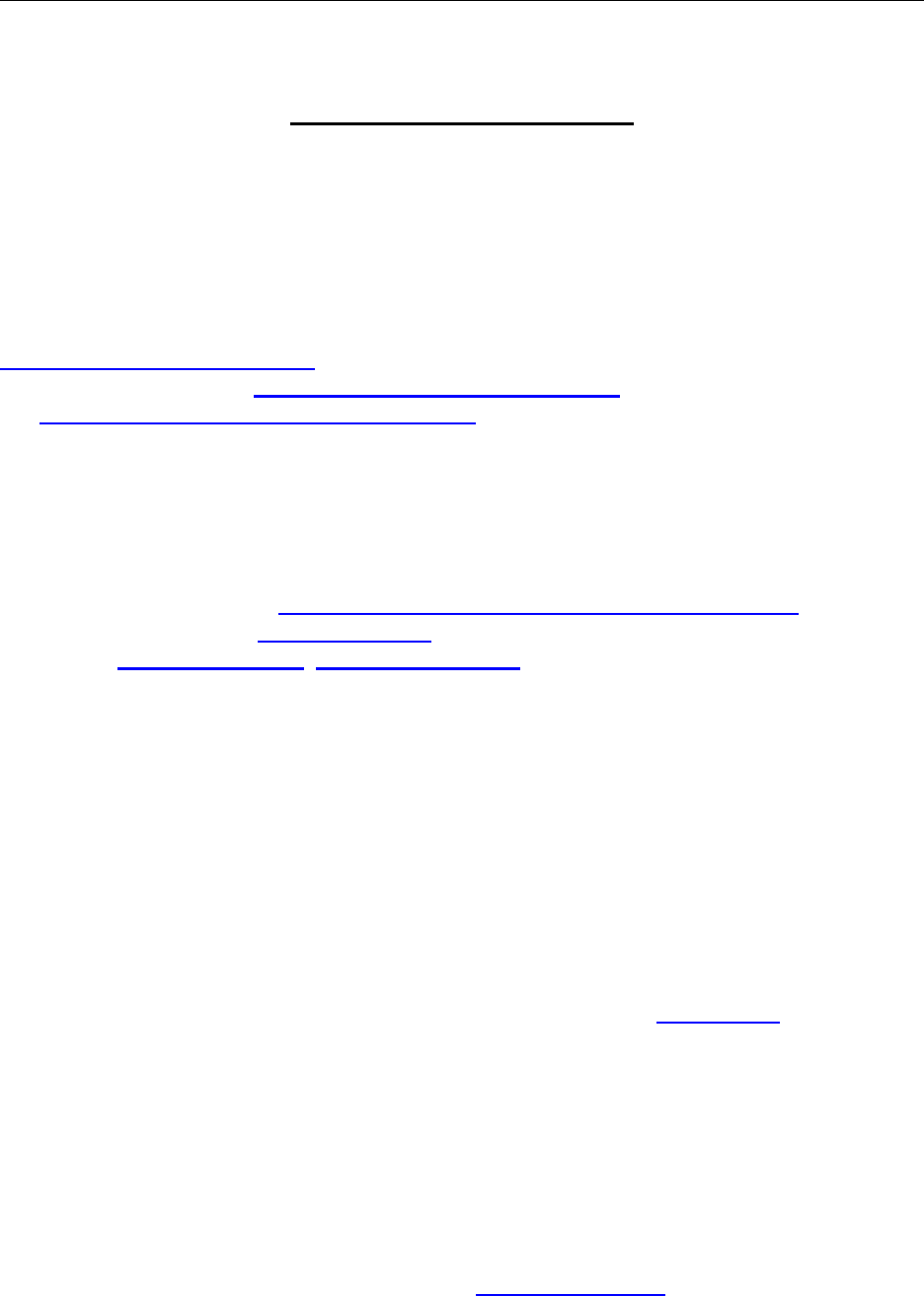

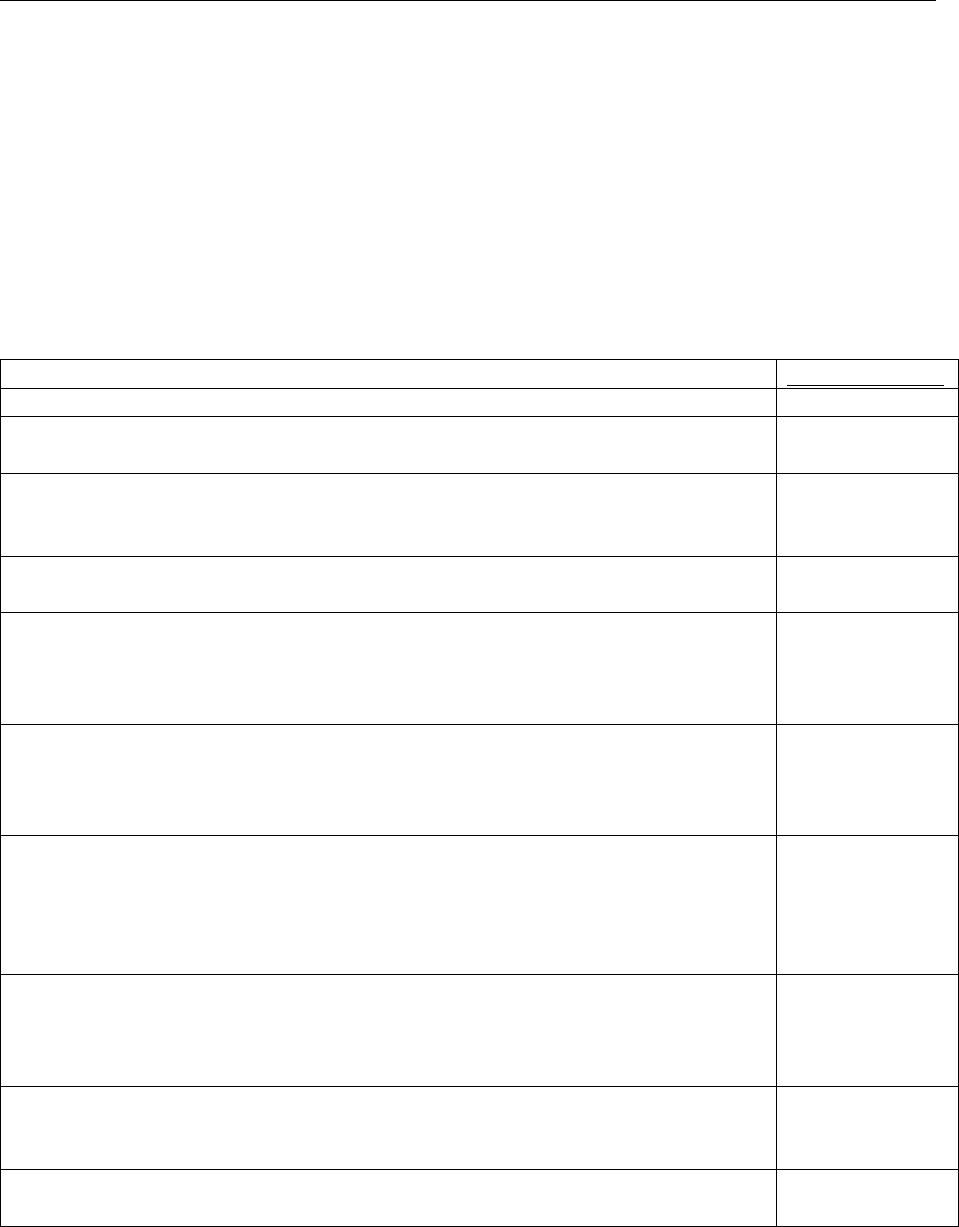

Figure 23-1. Approving/Billing Official and Certifying Officer Monthly Review Checklist

This checklist is for approving/billing official and certifying officer use in completing the

cardholder billing statement reconciliation, receipt and acceptance, and dispute procedures prior

to certification. The checklist is intended as a reference tool for use in examining the cardholder’s

purchase card statement received from the card-issuing bank.

Account Number: _____________________ Account Type: _____________________

Approving/Billing Official Name and Date: ________________________________________

Billing Statement Date: _______________

Review Steps

Date Completed

Obtain the cardholder statement, supporting documentation, and certification

from the cardholder.

Review purchases for each cardholder to determine whether all transactions

were authorized government purchases in accordance with the FAR, DFARS,

and all other government agency policy and procedures as applicable.

Reconcile supporting documentation with details on the billing statement.

Also, review for adequacy the purchase log entries for those transactions.

Resolve any questionable purchases and delinquent balances with the

cardholder and, if necessary, advise the cardholder to dispute transactions with

the card-issuing bank or report fraudulent transactions. Annotate disputed and

fraudulent transactions on the billing statement.

Review past transactions that were certified for payment without proof of

receipt and acceptance to confirm acceptance and receipt with the cardholder.

If receipt cannot be confirmed, then direct the cardholder to dispute the

transaction.

Annotate any identified delinquent balances and suspected purchase card

violations on the billing statement and report such matters to the A/OPC so the

transaction can be disputed or investigated as appropriate. In cases of suspected

external fraud, report the matter to the card-issuing bank in accordance with

DoD GPC Policy.

In the case of suspected internal fraud by government personnel (e.g.

cardholder/receiver), document the suspected internal

fraud and notify the

appropriate investigative office and the A/

OPC so the transaction(s) can be

investigated.

Ensure supporting documentation (e.g., approvals, receipts, logs, invoices, and

delivery orders) is included in the official repository in accordance with DoD

GPC Policy.

Sign or execute electronically the approving/billing official and certifying officer

certification statements, and forward the certified statements to the payment office.

10DoD 7000.14-R Financial Management Regulation Volume 10, Chapter 23

*April 2023

23-26

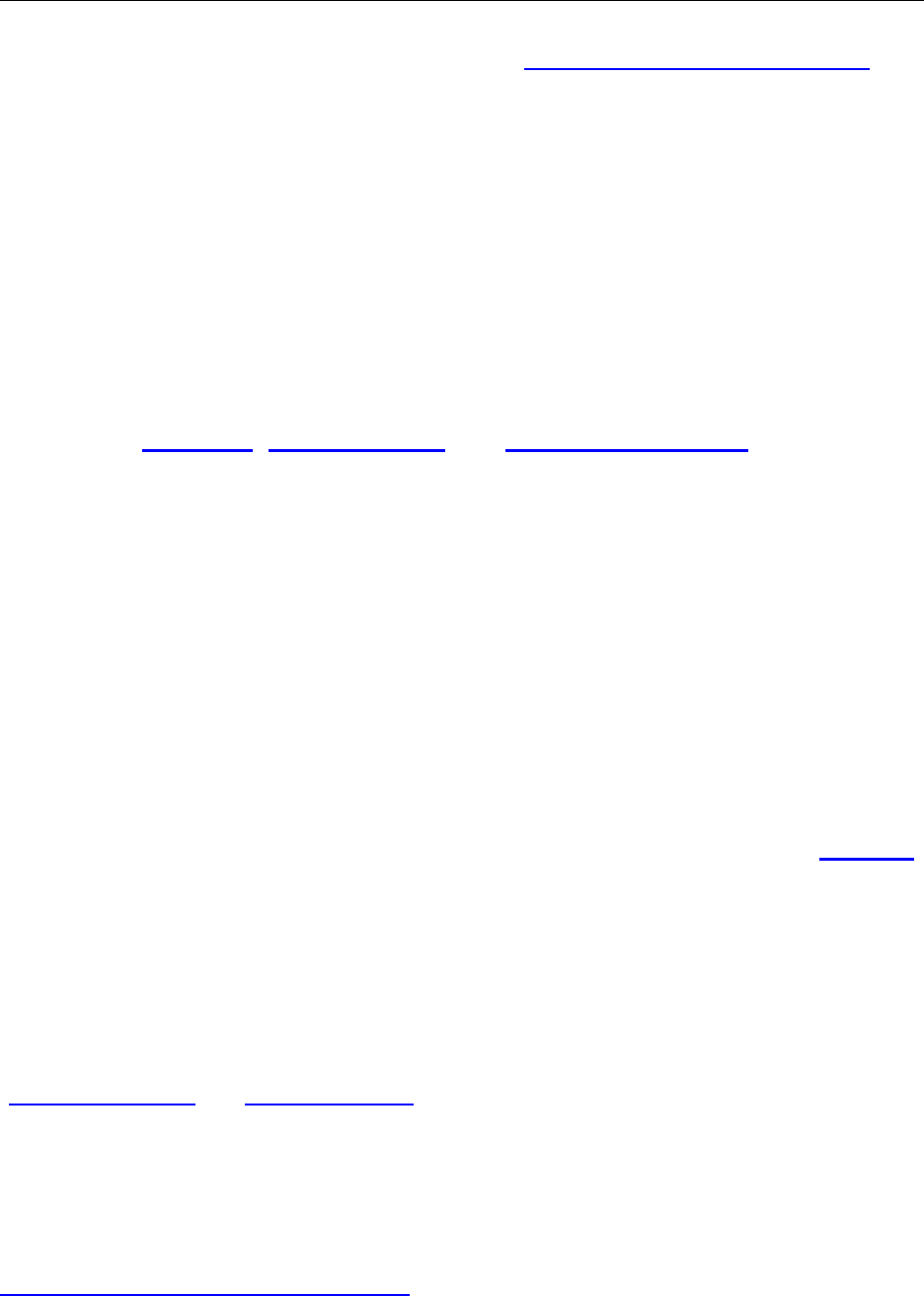

Figure 23-2. Purchase Card Certification Statements

• The Cardholder (as Accountable Official) certification statement will read:

“I certify that, except as may be noted herein or on supporting documents, the purchases

and amounts listed on this account statement:

(1) Are correct and required to fulfill mission requirements of my organization;

(2) Do not exceed spending limits approved by the Resource Manager;

(3) Are not for my personal use or the personal use of the receiving individual;

(4) Are not items that have been specifically prohibited by statute, by regulation, by

contract, or by my organization; and

(5) Have not been split into smaller segments to avoid dollar limitations.”

Authorized Cardholder Signature and Date (or electronic

signature)

• The Approving/Billing Official (as Accountable Official) certification statement will read:

“I certify that the items listed herein are correct and proper for payment from the

appropriation(s) or other funds designated thereon or on supporting vouchers, and that the payment

is legal, proper, and correct, except as may be noted herein or on supporting documents.”

_______________________________________________

Authorized Approving/Billing Official Signature and Date

(or electronic signature)

• The Purchase Card Certifying Officer certification statement will read:

“Pursuant to the authority vested in me, I certify that this invoice (billing statement) is

correct and proper for payment, except as may be noted herein or on supporting documents.”

Authorized Purchase Card Certifying Officer Signature and

Date (or electronic signature)