Before you submit your application, ensure

you have completed the following:

All required sections of the application.

Remembered to sign the application (you can sign digitally or print, sign,

scan and email completed application).

Been employed by a CIBC entity in the US Region for at least 90 days. If not,

please submit your application once you reach 90 days of employment.

Lifted any credit freezes on your information with Experian or TransUnion.

We cannot process your application if a freeze is in place. You can reinstate

the freeze once you have been notified of your loan decision.

Included your Social Insurance Number (SIN) and signed the Canadian

Credit Report Consent form if you have a Canadian credit profile and consent

to CIBC Bank USA evaluating this information.

The CIBC logo is a registered trademark of CIBC, used under license. © 2020 CIBC Bank USA

02115

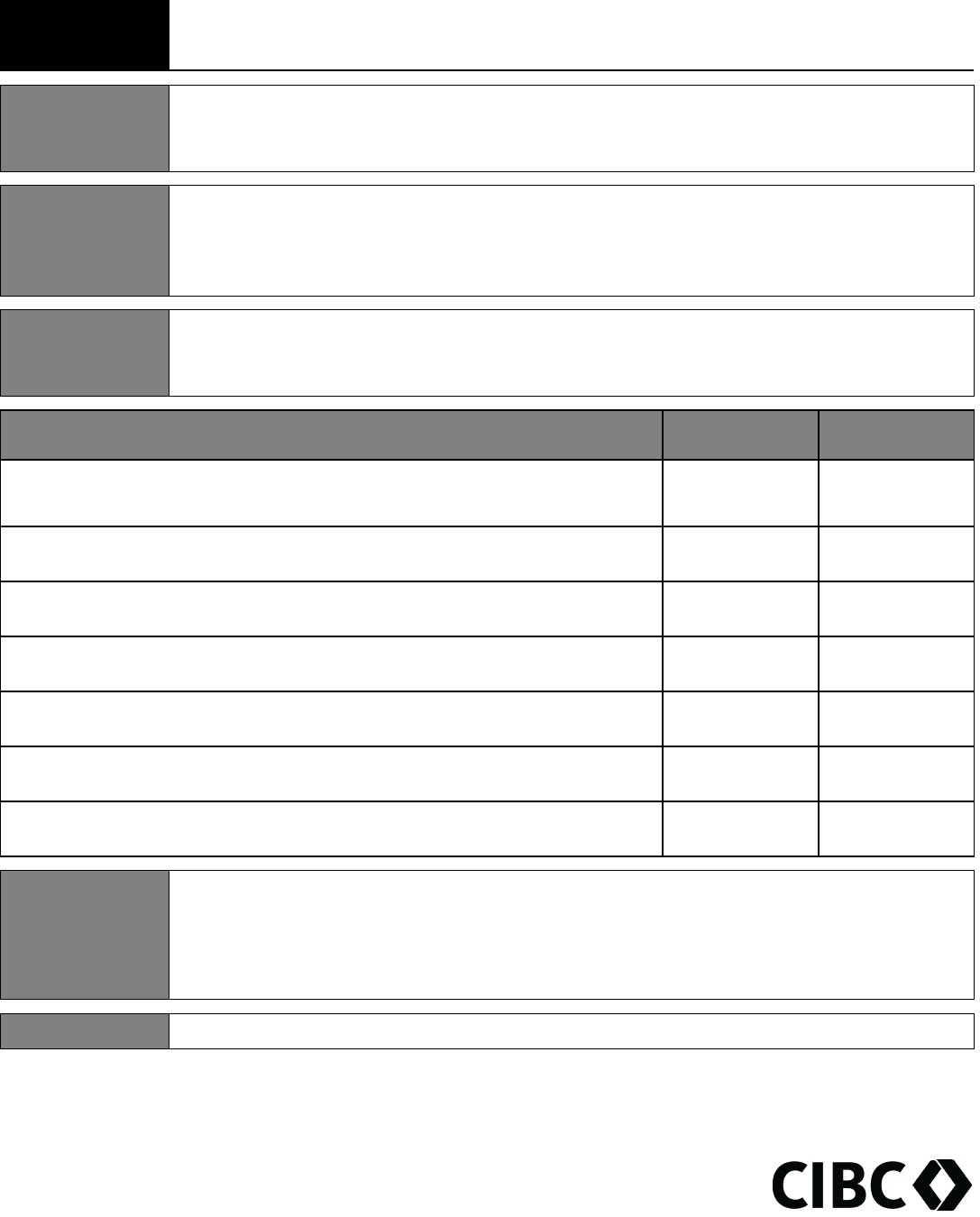

Employee Purpose Loan Consumer Credit Application

Section A: Type of Credit Requested

Purpose of Credit: Personal/Other

Loan Amount Requested (up to $5,000): Requested Term Loan (up to 4 years):

Section B: Applicant Information

Name:

Present Address:

City: State: Zip:

Previous Address (if you have lived at your present address for less than a year):

Date of Birth: Home Phone: Personal Cell:

Personal Email Address: Social Security Number:

For applicants providing a Social Insurance Number: Providing your Social Insurance Number is optional. If you choose to provide your Social

Insurance Number, CIBC Bank USA can obtain and use your Canadian credit profile to evaluate your application for this product. Note that

pulling a credit report may impact your credit score.

I understand and choose to provide this information

Social Insurance Number:

Driver’s License/State ID Number: State/Issuing Authority: Issue Date: Expiration Date:

Immigrant Status: U.S. Citizen Permanent U.S. Resident Other

Employer (CIBC Legal Entity): Position: Years/Months There:

Prior Employer Name/Address (if employed in current position les s than two years)

Closest Relative Information (not living with you)

Name:

Phone Number:

Address:

Section C: Additional Information

Have you ever filed for bankruptcy (Chapter 7 or 13) in the past 10 years? Yes No

Have you had property foreclosed on or given title or a deed-in-lieu of title in the past 7 years? Yes No

If yes, when?

Do you have any unsatisfied judgments against you? Yes No

If yes, when?

Do you currently have any outstanding loan with CIBC Bank USA? Yes No

Employee Purpose Loan

Important Information about Procedures for Opening a New Account: To help the government fight the funding of terrorism and

money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies

each person who opens an account. What this means for you: When you open and account, we will ask for your name, address,

date of birth, and other information that will allow us to identify you.

The Employee Purpose Loan opened at CIBC Bank USA is to be used exclusively for and by the named applicant and cannot be

used to transact on behalf of a third party. This does not prohibit the use of a legally authorized representative, such as a guardian

or an agent acting under a valid Power of Attorney (POA), to act on behalf of the named borrower. I agree that this account will

not be used by or on behalf of a third party unless a legally authorized representative is acting on my behalf.

I understand the limitations of the Employee Purpose Loan usage which prohibit the following: paying o debt at an aliate entity

of CIBC Bank USA or otherwise having proceeds of this loan be transferred to an aliate entity of CIBC Bank USA; purchasing

CIBC stock; paying for post-secondary education expenses; for the sale, distribution, marketing, or production of medical or

recreational marijuana, medical or recreational cannabis or any constituent cannabinoids such as THC, as well as any substance

considered to be synthetic cannabinoids (this limitation applies broadly, regardless of whether the activity is conducted by

collectives, collective caregivers, co-ops, growers, or any other entity or organization); for the sale, distribution, or manufacture of

any type of drug paraphernalia; or for any other illegal purpose.

I understand that if my employment with the Bank is terminated (voluntarily or involuntarily) during my repayment term, my

interest rate and payment amount will be adjusted to market rate on the eective date of my employment termination. I am

responsible for satisfying the loan balance at the new terms and conditions that apply for the life of my loan. These terms are

outlined in the Employee Purpose Loan Promissory Note and should be carefully reviewed before obtaining the loan. Please reach

out to the Client Support Center at (833) 824-2287 with any questions.

Representations and Warranties: I certify that all the information on this loan application is true and complete and is made

for the purpose of determining my eligibility for credit. I agree that this application remains your property, whether or not the

application is accepted. You are authorized to make all inquiries you deem necessary to verify the accuracy of the statements

made on this application, and to determine my credit worthiness, including, but not limited to, obtaining consumer reports from

consumer reporting agencies; credit information from banks, other financial institutions, and creditors.

CIBC Bank USA Electronic Disclosure Consent Agreement – Employee Purpose Loan

General

This CIBC Bank USA Electronic Disclosure Consent Agreement (“E-Sign Consent”) applies to all communications for the

Employee Purpose Loan product provided by CIBC Bank USA. You should read this entire document carefully before consenting

to the E-Sign Consent as part of the application process. By accessing this document, you are demonstrating your ability to access

electronic communications in this format prior to consenting to this E-Sign Consent. You must agree to this E-Sign Consent

in order to process your Employee Purpose Loan application electronically. Failure to provide consent may result in longer

processing time for your loan application.

Definitions

The terms “we,” “us” and “Bank” refer to CIBC Bank USA or any aliate, agent, independent contractor or designee that we may

use to provide CIBC Bank USA products or services. The terms “you” and “your” refer to the applicant of the CIBC Bank USA

Employee Purpose Loan. The term “Communications” means any and all communications from the Bank to you, including, but not

limited to, any customer agreements, including any amendments; disclosures; notices; responses; transaction histories; privacy

policies; and any and all other information related to CIBC Bank USA products and services, including any information that we are

required by law to provide to you in writing.

Scope of Communications to be provided in Electronic Form

When you apply for an Employee Purpose Loan via a digital application, you agree that we may provide you with all

Communications in electronic form and that we may discontinue sending paper Communications to you, unless you withdraw

your consent as provided in this E-Sign Consent. We may still choose, at our election, to provide you with any Communication in

paper form. Your consent to receive electronic Communications includes, but is not limited to, consent to receive the following

electronically:

• All legal and regulatory disclosures and Communications associated with the Employee Purpose Loan product.

• Notices or disclosures about a change in the terms of this E-Sign Consent.

• Our responses to your requests related to your accounts and services at the Bank.

This consent to receive Communications electronically does not enroll you in:

• CIBC NetBanking Services

• Digital Banking Services

• eStatements

• Any service that provides your Bank deposit or loan account documents electronically.

If you would like to use CIBC NetBanking Services, please enroll directly through the link on our website cibc.com/US. If you

would like to receive your Bank deposit account communications electronically and no longer receive paper communications,

please use CIBC NetBanking Services to sign up for our eStatement service.

Method of Providing Communications to You in Electronic Form

The Bank will use your CIBC company email address to provide all electronic communications to you.

How to Withdraw Consent

You may withdraw your consent to receive Communications in electronic form by contacting us at CIBC Bank USA, 6825 West

111th St. Worth, IL 60482, Attention: CIBC Client Services – Employee Banking. However, withdrawal of your consent to receive

Communications electronically may result in a delay in processing your application. The Bank, at our option, may suspend any

such application you have with us indefinitely until such time as the Bank can support non-electronic processing. Any withdrawal

of your consent to receive electronic Communications will be eective only after we have a reasonable period of time to process

your withdrawal. At our option, we may treat your provision of an invalid e-mail address or the malfunction of a previously valid

e-mail address as a withdrawal of your consent to receive electronic Communications.

How to Update Your Records

For the duration of your employment with us, the Bank will use your CIBC company email address to provide all electronic

communications to you. Upon voluntary or involuntary termination, it is your responsibility to provide the Bank with an alternate

email address for communications. You can request updates to your other account information by contacting us at:

CIBC Bank USA

6825 West 111th St.

Worth, IL 60482

Attention: CIBC Client Services – Employee Banking

Telephone: 833 824-2287

To help protect the confidentiality of your personal information, please do not send us any information regarding your Employee

Purpose Loan Application outside of your CIBC email.

Hardware and Software Requirements

In order to access, view, and retain electronic Communications that we make available to you, you must have:

• An Internet browser that supports 128 bit encryption;

• Sucient electronic storage capacity on your computer’s hard drive or other datastorage unit;

• A valid CIBC e-mail account and access to CIBC issued e-mail software;

• A personal computer (Pentium 120 Hhz; or higher or Macintosh, Power Mac, 9500, Power PC 604 processor 120-Mhz Base

or higher) or mobile device, operating system and telecommunications connections to the Internet capable of receiving,

accessing, displaying and either printing or storing Communications received from us in electronic form via a plain text-

formatted e-mail or by access to our website using a browser that meets the requirements specified above; and

• Adobe Acrobat Reader 6.0 or higher or other software that enables you to view Portable Document Format (PDF)

documents. If you are able to read this Consent Agreement, you have a sucient version of software to read our electronic

Communications to you. If you cannot access this document from your computer or mobile device, you need to download

Adobe Acrobat Reader or other software to be able to view electronic Communications provided in PDF format.

Requesting Paper Copies

To request a paper copy of a Communication, contact us at:

Phone Number: 833 824-2287

Or send your written request to:

CIBC Bank USA

6825 West 111th St.

Worth, IL 60482

Attention: CIBC Client Services – Employee Banking

We reserve the right to provide a paper (instead of electronic) copy of any Communication that you have authorized us to provide

electronically.

Communications in Writing

All Communications in either electronic or paper format from us to you will be considered “in writing.” You should print or

download a copy of this E-Sign Consent and any other Communication that you wish to keep for your records.

Federal Law

You agree that your consent to electronic Communications is being provided in connection with a transaction aecting interstate

commerce that is subject to the federal Electronic Signatures in Global and National Commerce Act (E-SIGN Act).

Termination and Amendments

We reserve the right, in our sole discretion, to discontinue the provision of Communications in electronic form, or to terminate

or change the terms and conditions on which we provide electronic Communications. We will provide you with notice of any

termination or change as required by law.

Consent

By selecting the box next to “I read and agree to the CIBC Bank USA Electronic Disclosure Consent Agreement – Employee

Purpose Loan. I would prefer to have my application processed via my CIBC Email and to receive Communications electronically,”

you are consenting to having electronic Communications provided to you as described in this E-Sign Consent. You agree that you

and your computer or mobile device satisfies the hardware and software requirements specified in this E-Sign Consent, that you

have access to your current CIBC e-mail address, and that you were able to view, download, and print this E-Sign Consent.

Please select one:

I read and AGREE to the CIBC Bank USA Electronic Disclosure Consent Agreement – Employee Purpose Loan. I would

prefer to have my application processed via my CIBC Email and to receive Communications electronically.

I read and DO NOT AGREE to the CIBC Bank USA Electronic Disclosure Consent Agreement – Employee Purpose Loan.

I would prefer to have my application processed via mail. I understand that this may result in a significantly longer

processing time for my application.

Applicant Signature Date:

Products and services are oered by CIBC Bank USA. The CIBC logo is a registered trademark of CIBC, used under license. © 2020 CIBC Bank USA

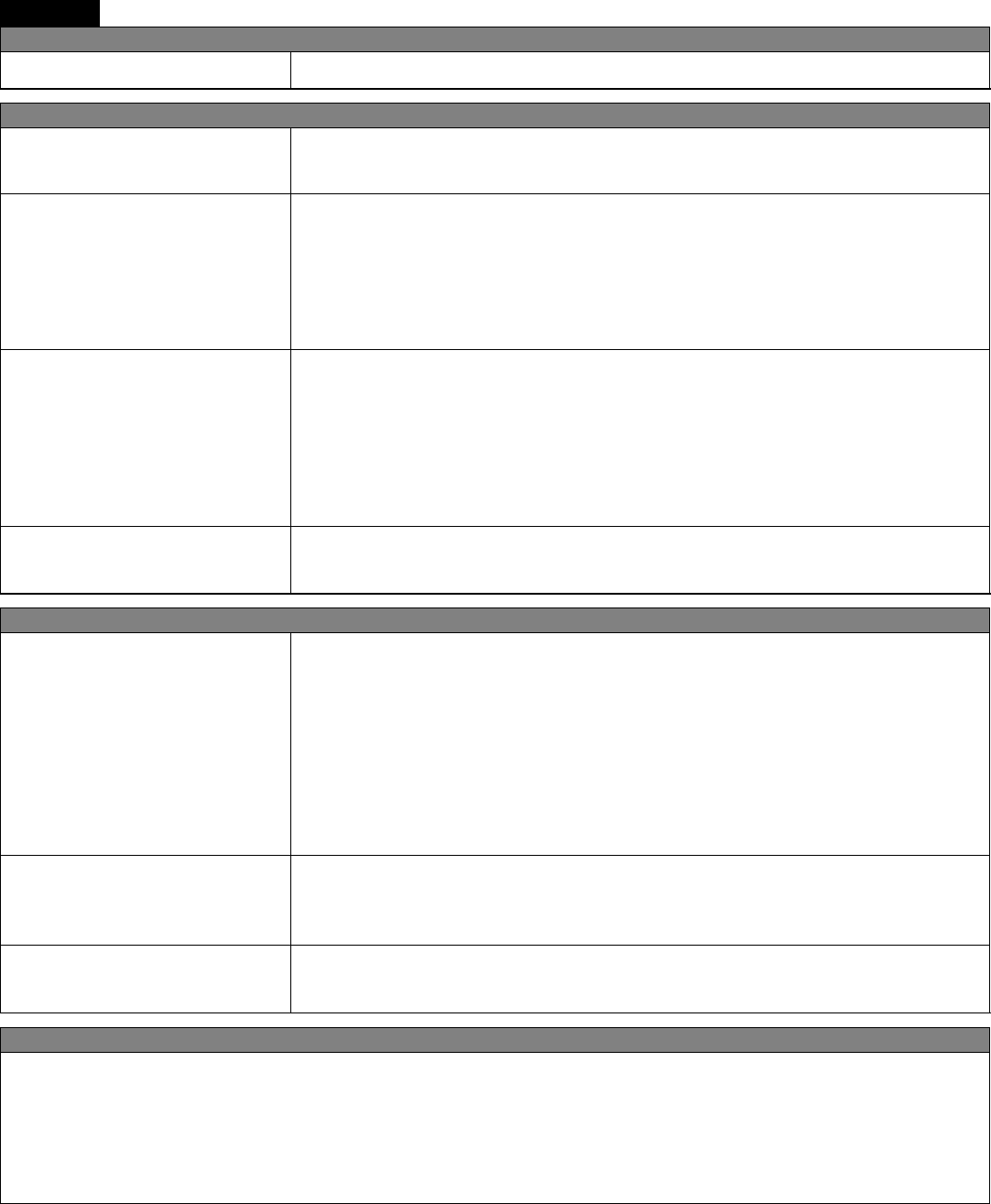

FACTS

Rev. 11/2018

WHAT DOES CIBC BANK USA DO WITH YOUR

PERSONAL INFORMATION

Why?

Financial companies choose how they share your personal information. Federal law gives

consumers the right to limit some but not all sharing. Federal law also requires us to tell you how

we collect, share, and protect your personal information. Please read this notice carefully to

understand what we do.

What?

The types of personal information we collect and share depend on the product or service you have

with us. This information can include:

• Social Security number and account balances

• Account t

ransactions and checking account information

•

Transaction history and wire transfer instructions

How?

All financial companies need to share customers’ personal information to run their everyday

business. In the section below, we list the reasons financial companies can share their customers’

personal information; the reasons CIBC Bank USA (CIBC) chooses to share; and whether you can

limit this sharing.

Reasons we can share your

personal information

Does CIBC

share?

Can you limit

this sharing?

For our everyday business purposes -

such as to process your transactions, maintain your account(s), respond to court

orders and legal investigations, or report to credit bureaus

Yes No

For our m

arketing purposes -

to offer our products and services to you

Yes No

For joint marketing with other financial companies

Yes No

For our affiliates’ everyday business purposes –

information about your transactions and experiences

Yes No

For our a

ffiliates’ everyday business purposes -

information about your creditworthiness

Yes Yes

For our affiliates to market to you

Yes Yes

For nonaffiliates to market to you

No We don’t share

To limit our

sharing

Call toll-free: 877-448-6500

Please note: I

f you are a new customer, we can begin sharing your information 30 days from the

date we sent this notice. When you are no longer our customer, we continue to share your

information as described in this notice.

However, you can contact us at any time to limit our sharing.

Questions?

Call toll-free 877-448-6500 or go to cibc.com/US

Page 2

Who are we

Who is providing this notice?

This notice is provided by CIBC Bank USA.

What we do

How does CIBC protect my

personal information?

To protect your personal information from unauthorized access and use, we use

security measures that comply with federal law. These measures include computer

safeguards and secured files and buildings.

How does CIBC collect my

personal information?

We collect your personal information, for example, when you:

• Open an account or make deposits or withdrawals from your account

• Pay your bills

or apply for a loan

• Use your debit card or make a wire transfer

We also collect your personal information from others, such as credit bureaus,

affi

liates, or other companies.

Why can’t I limit all sharing?

Federal law gives you the right to limit only:

• Sharing for affiliates’ everyday business purposes - information about your

creditworthiness

• Affiliates from using your

information to market to you

• Sharing for nonaffiliates to market to you

State laws and individual companies may give you additional rights to limit sharing.

See below for more on your rights under state law.

What happens when I limit

sharing for an account I hold

jointly with someone else?

Your choices will apply individually—unless you tell us otherwise.

Definitions

Affiliates

Companies related by common ownership or control. They can be financial and

nonfinancial companies. Our affiliates include companies with the CIBC name and

include the following financial companies:

• CIBC National Trust Company;

• CIBC Private Wealth Advisors, Inc.;

• CIBC Delaware Trust Company;

• CIBC Private Wealth Group, LLC;

• Canadian Imperial Bank of Commerce;

• CIBC World Markets Corp.; and

•

CIBC Inc.

Nonaffiliates

Companies not related by common ownership or control. They can be financial and

nonfinancial companies.

• CIBC Bank USA does not share with nonaffiliates so they can market to

you.

Joint marketing

A formal agreement between nonaffiliated financial companies that together market

financial products or services to you.

• Our joint marketing partners include credit card companies.

Other Important Information

State Laws:

For California residents: We will not share information we collect about you with nonaffiliates, except as permitted by

California law, such as to service your account. We will limit sharing among our affiliates to the extent required by

California law, unless you authorize us to make those disclosures.

For Vermont residents:

We will not share information we collect about you to nonaffiliated third parties, except as

permitted by Vermont law, such as to service your account. We will limit sharing among our affiliates to the extent

required by Vermont law, unless you authorize us to make those disclosures.

CIBC Bank USA Canadian Credit Bureau Consent

By signing this consent form, you consent to the following:

You consent to the collection, use, and sharing of your personal information from time to time as

provided in the CIBC Bank USA Privacy Notice provided to you in connection with your loan

application. The notice is also available online on our website at us.cibc.com.

You consent to CIBC Bank USA from time to time obtaining your credit, financial and related personal

information, including a consumer or credit bureau report about you from, and disclosing this

information to, any credit or consumer reporting agency or any third party with whom you have had or

may have a financial relationship.

You acknowledge this information may be obtained about you in connection with this application,

including to: determine whether credit will be granted and your ongoing creditworthiness; qualify you

for products and services; verify your identity and protect against fraud; service your account; tell you

about other products; or comply with law. This credit bureau consent is effective immediately and is

valid for a reasonable period of time after your relationship with CIBC Bank USA has ended. CIBC Bank

USA will provide you the name and address of the credit or consumer reporting agency upon request.

You agree that we may share your information, including your Social Insurance Number (SIN), with a

credit bureau to obtain credit information about you.

Applicant: __________________________ SIN#: _____________________ Date: _____________

________________________________________

Applicant Signature